- HX Daily

- Posts

- HX Weekly: December 15 - December 19

HX Weekly: December 15 - December 19

Interest Rates & Stocks: How They Matter and Wisdom From Gerald Loeb

Hello reader, welcome to the latest issue of HX Weekly!

Each week we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

Interest Rates and Stocks – An Update

A year ago, on this exact date we wrote a note describing the relationship between stocks and interest rates.

That note – like this one – was written shortly after the final meeting of the Federal Reserve for the year.

At the time, there was quite a bit of concern as after the Fed had made its most recent cut in the Fed Funds target rate (dropping it -0.25%), the yield on the benchmark US Government 10-Year Bond had gone higher.

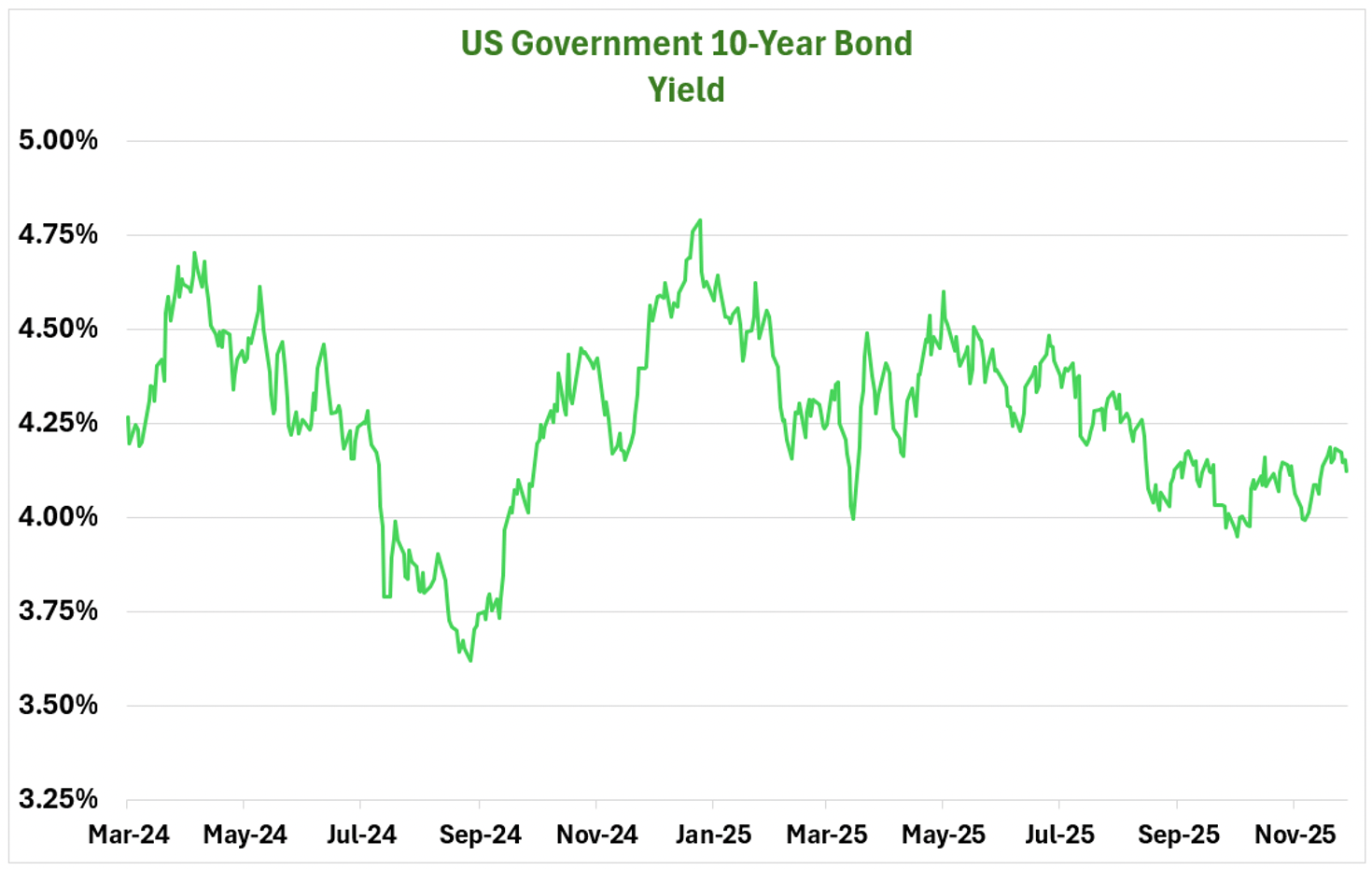

Below is a chart of the yield on the 10-year for the last couple of years…

On the chart you can see that rates moved up from below 3.75% to over 4.75% from August 2024 to January 2025.

Again, this was after the Fed had begun cutting rates, so this caused quite a bit of worry amongst investors.

At the time we argued that there was no greater meaning to the move other than many investors had positioned themselves ahead of the Fed rate cuts.

Look how rates had fallen from their highs in April 2024 to the lows in August. The total move was about 1%, or the same move that happened when rates moved higher.

Looking at that period, rates essentially ended up flat.

Our point was that the short-term moves didn’t matter much to the economy or the stock market. The key was where the rates would end up and whether they would move a lot.

Well, they ended up right where they started and this has been the story for the last few years.

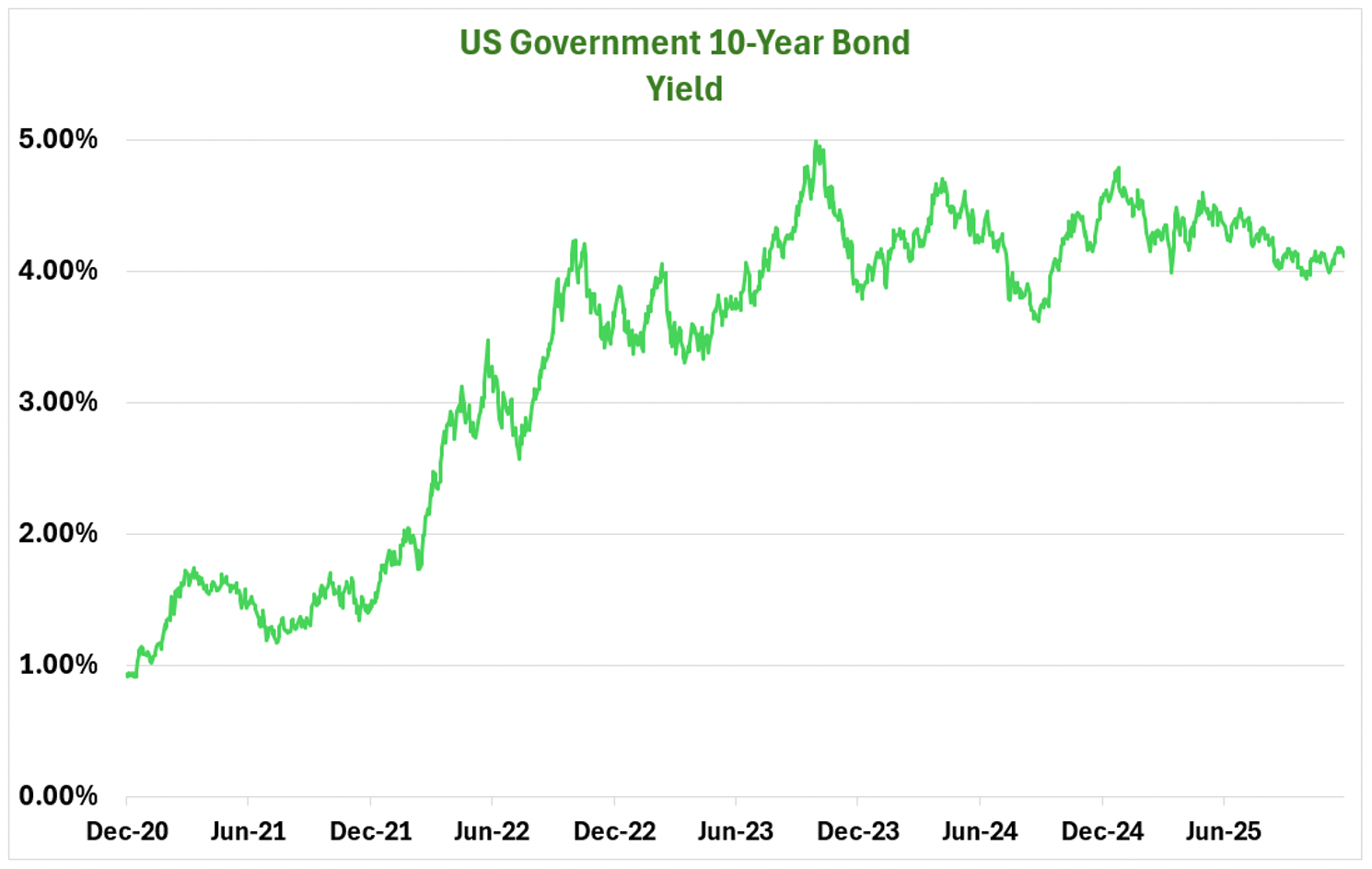

Here is the same chart of 10-year yields but going back to 2020…

On this chart you can see that we have been a range of 3.5% to 5% for the last three years.

In that original note we made the point that the economy responds to two situations with interest rates.

First, when they move higher quickly.

That is what happened from 2021 to 2022 as the Federal Reserve moved aggressively to address the highest inflation in years.

While rates themselves did not go very high on an absolute basis (the Fed Funds rate peaked at a little over 5%), the move from almost zero to 5% in about a year was a lot for folks to digest.

Once rates stopped moving higher the stock market settled down very nicely and began the current BULL market we have been enjoying since then.

The other situation where rates could have a real impact is if they were high on an absolute basis.

What do we consider “high”?

Our view is that high single digits or especially double digits would have a real impact on the economy.

The good news is that we have not seen that level of interest rates since the 1980s and we don’t think that is by accident.

While we may see that level of rates again in our lifetime, we don’t think we are going to see them anytime soon.

In fact, go back to the first chart above, showing interest rates over the last several years.

Do you see what happened after rates peaked in January?

They have gone steadily lower.

We think this is a good development for the economy and stock market, and they have both responded.

It looks like Q4 GDP could be the highest in several years and we have once again seen double digits returns in the major stock market indices.

Given the recent Fed rate cuts, this week’s inflation number, and the likelihood of a more “dovish” new Fed Chairman in 2026, we think rates will go even lower. Perhaps much lower.

We think this will be – again – good for the economy and stocks.

One last aspect of this relationship to think about is an observation we heard on CNBC earlier this week.

One of the strategists for the major investment banks made the observation that every major stock market sell-off of note in the last thirty years has been marked by the Fed RAISING rates.

Here is a chart showing the upper bound of the Fed Funds Target rate going back to 1990…

We have circled the periods where they have been raising rates, and this coincides perfectly with each of the major selloffs.

His more specific point is that a BUBBLE only bursts after the Fed starts raising rates.

We think that will happen at some point in the future, but that point is not soon.

In our mind this says to us that interest rates will continue to be a tailwind for stocks and potentially a stronger one in 2026 than they were even in 2025.

HX Daily Redux

Interest Rates and Stocks: How They Matter Right Now

Below is the note we wrote a year ago, on this exact date, describing the relationship between stocks and interest rates.

With the final Federal Reserve meeting of the year, we share our thoughts on interest rates and the role they play in the stock market right now…

One of the most often discussed relationships in financial markets it the relationship between interest rates and the stock market.

It is a complicated relationship that is difficult for investors to understand.

The most significant difficulty is that the relationship CHANGES.

How stocks react to movements in interest rates can depend on many factors. Two of the main factors are where we are in the economic cycle and current investor expectations.

There are also big differences in the kinds of moves we see in interest rates. Size and speed matter in terms of the impact on the stock market.

We have seen the stock market move sideways in the last week or so.

This has coincided with an upward movement in interest rates. Are these two moves correlated?

Let's examine the movement in interest rates. Here is a chart of the recent yields on the US government benchmark ten-year bond…

The yield has increased from 3.6% to 4.2% since the middle of September, as shown at the end of the chart.

Critics see this as a very bad sign, especially after the Federal Reserve Bank had just cut interest rates. Some say it is a sign of the collapse of confidence in the US dollar and the US government’s ability to borrow money.

We point out that interest rates are back to where they were in July. This is NOT a big deal.

The move is just not that big. At the start of the year, yields went from 3.8% to almost 4.8%. Do you know what the stock market did during that period? It soared!

This is where the size and speed of a move make a difference.

Let’s take a look at the chart of this yield across the last five years…

Look at the size of this most recent move. It doesn’t even show up on the chart.

The fact is that this size of move really doesn’t mean anything for stocks.

In fact, our argument has been supported by the absolute level of interest rates in recent years—the higher rates also have not mattered very much.

Whether rates are at 2% or 5%, it's not that big of an economic impact.

It would be a much bigger issue if we were talking about 10%, 15%, or even 20%. Those were the kinds of levels that we saw back in the 1970s and 1980s, and they had a major impact on the economy and stocks.

Rates were high enough—and the changes in them impactful enough—that they could put companies out of business. A move from 5% to 15% is a BIG move. A move from 2% to 4% is NOT.

In 2022, though, interest rates DID matter to the economy and stock market. If absolute rates and the move in rates were both low, why did they still have an impact?

The answer is the VELOCITY—the speed of the move.

Most companies didn't care about interest rates at 1% or 5% as the impact on their business was minimal.

That rate movement, though, happened in just a little bit more than a year. THIS was difficult for companies to digest.

Again, they didn't care about the low rates, but they did care as they moved. Planning out your business operations is hard when the rates are moving so quickly.

You can see this in the action of stocks.

Here is a chart of the yield of the 10-year government bond along with the price of the S&P 500…

In red, we highlight the period when bond yields were moving higher rapidly.

The stock market sold off during this period. Companies had trouble adjusting to rapidly changing interest rates, and earnings estimates saw negative revisions.

Once the rates STOPPED going up as rapidly, though, and reached some stability (the green), the stock market found its footing and moved higher.

In fact, the first rate peak occurred in October 2022, which also marked the bottom and the start of the current BULL market.

This chart shows that interest rates CAN matter to the stock market. We just don’t think that they matter much right now…

Market Wizard’s Wisdom

An Old School Money Master: Gerald Loeb

Knowing history is one of the many benefits of having spent three decades working on Wall Street and investing.

Today, we are familiar with many great investors like Warren Buffett, Bill Ackman, Ken Griffin, etc., but there is an entire generation of investors from the 20th century.

In today’s Market Wizard’s Wisdom, we profile another great investor – Gerald Loeb.

Loeb was the founding partner of E.F. Hutton & Co., the most famous brokerage firm of its day. Imagine a combination of Merrill Lynch, Fidelity, and Robinhood all rolled up into one.

Their trademark motto – “When E.F. Hutton talks, people listen!” – still rings in the ears of older investors. Here is that commercial…

While the brokerage was named after San Francisco stockbroker Edward Francis Hutton in 1904, it was in 1924, when Loeb joined, that it became prominent.

Loeb was one of the most prominent personalities on Wall Street and was famous for two books – The Battle for Investment Survival (1935) and his follow-up, The Battle for Stock Market Profits (1971).

Here are some quotes sharing some of his insight…

“Human nature being what it is, a person buying a stock at the wrong time is very apt to double his error and sell it at the wrong time.”

As our readers know, we spend much time discussing human psychology and its impact on our TRADING and INVESTING.

One of the hardest aspects of TRADING is putting yourself in a position to be in the proper mindset to WIN.

When we start with a mistake, we often put ourselves in a position where we will make even more mistakes.

“If you don’t feel confident enough to invest a sum that is important to you, better look for something else.”

We spend much time talking about the importance of selectivity in your positions.

Loeb says this another way – if the idea isn't good enough to risk an amount that would hurt, don't even bother doing it.

Small positions that are low confidence can be a distraction and hurt your portfolio as a whole. Again, put yourself in a position to win.

“But remember, life is a succession of cycles. Day and night. Hot and cold. Good times and bad. High prices and low. Dividends increased, and dividends cut. So don't expect your investments to be the exception to the rule.”

This one is some good life advice also…

We often think of our investment (and life) as a destination and are obsessed with the result. The result is important, but the path is a journey and often a volatile one.

Learning to manage that volatility is key to maintaining your process and conviction to succeed.

“ ‘Buy low, sell high’ is one of those wonderful ideas which may work out well for those who can learn the ropes. It can be a rather expensive idea if it is just applied as a generalization.”

You will hear some of the most famous and successful investors out there (like one of our favorites, William O'Neil) criticize this famous Wall Street axiom.

We think that is unfair as they seldom get into the details of why it can be dangerous.

Loeb at least points out that using it as a hard and fast rule without an additional process can be bad for your portfolio.

Like any TRADING or INVESTING rule – it works, but the key is the application.

“It is true that, strictly speaking, short-term trading is speculative. But so is all intelligent investing.”

We love this quote!

The “smart” money often looks down on TRADING as somehow not as valid as INVESTING. It dismisses it as being unsound or unsafe.

We have seen long-term investors do MUCH MORE damage to their net worth than we have traders.

With both – it is all about your method and process.

Plan the Trade. Trade the Plan.

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply