- HX Daily

- Posts

- HX Weekly: July 7 - July 11, 2025

HX Weekly: July 7 - July 11, 2025

Tokenized Securities, the 2000 Bull Market & More

Hello reader, welcome to the latest issue of HX Weekly!

So, what's HX Weekly all about?

Each Friday, we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Market

The Next Financial Revolution: Tokenized Securities & 24/7 Markets

In the investing world, a significant shift is quietly taking shape, one that could change how stocks, bonds, and even real estate are traded forever.

It's called tokenization, and it's all about turning traditional financial assets into digital tokens using blockchain technology.

These tokens represent ownership in real-world assets, but instead of sitting in old-school databases or paper records, they live on secure, decentralized digital ledgers.

The result? Faster, cheaper, and potentially around-the-clock trading.

Tokenized securities aren’t a far-off dream anymore. Over the past five years, progress has steadily moved from theory to practice.

In 2020, a handful of experimental projects showed the benefits of tokenizing private equity and debt.

By 2023, major financial players like BlackRock and JPMorgan were piloting blockchain-based systems to tokenize money market funds and treasury products.

Fast forward to 2024, and the SEC began exploring rule updates to support “digitally native” securities, making it clear this transformation is no longer just a tech buzzword.

Now, in 2025, we're on the verge of tokenized securities becoming a legal reality in the U.S. for retail and institutional investors alike.

The most likely rollout scenario will begin with private markets. Think hedge funds, venture capital, and debt products. This will be followed by the tokenization of public stocks and ETFs over the next 12–24 months.

This will probably happen in phases.

First, compliant digital exchanges will be approved to list tokenized versions of existing assets. Then, broker-dealers will be cleared to trade them under updated securities regulations.

Finally, major indices like the NYSE and Nasdaq may begin listing "digital twins" of traditional stocks that are tradable on blockchain rails. The complete transition to 24/7 trading could follow shortly after.

Companies positioned to benefit immediately include Circle (CRCL), which issues USDC, the leading regulated dollar-backed stablecoin. Circle’s infrastructure already powers instant, blockchain-based payments that will be critical to settling tokenized trades.

Then there’s Coinbase (COIN), which recently applied for expanded broker-dealer permissions and is quietly building an institutional-grade platform for tokenized securities.

Coinbase's advantage lies in its tech infrastructure, user base, and partnerships with stablecoin issuers and blockchain foundations. Firms like these are laying the rails for a new financial system.

Robinhood (HOOD) is already live in Europe, offering tokenized versions of over 200 U.S. stocks and ETFs on a customized Arbitrum-based chain.

They're also running token products tied to private companies like OpenAI and SpaceX via special purpose vehicles (SPVs). Thanks to this early rollout, Robinhood is firmly among the immediate beneficiaries of tokenization.

Looking ahead, other players will join the winners' circle as the market matures.

These include traditional custodians like Fidelity, and State Street, who are building secure wallets and token management systems. BlackRock and Franklin Templeton, already experimenting with tokenized funds, could eventually convert entire portfolios.

Even companies in the infrastructure layer, like Fireblocks and Avalanche (AVAX), could benefit by providing the technical backbone for institutions to tokenize and move assets securely.

Now, while trading financial assets 24/7 sounds great, it raises significant questions for everyone from investors to exchanges.

For retail investors, tokenization and all-hours access are a dream come true. No more waiting for Monday morning to react to big news. You could buy or sell Apple stock at midnight on a Saturday. But with constant access also comes greater risk: emotional trading, burnout, and the challenge of separating life from markets.

Professional investors, hedge funds, and algorithms will likely dominate these new digital markets at first, using speed and liquidity advantages to their benefit.

Existing brokerages and stock exchanges will be forced to adapt or risk falling behind. Nasdaq and NYSE, for example, may be pressured to support digital versions of assets to remain competitive. Firms like Charles Schwab may need to overhaul backend systems to plug into blockchain rails.

And with round-the-clock trading, the old concept of “market close” could disappear, forcing everyone from compliance officers to financial journalists to rethink how they operate.

Indices and ETFs may also need to evolve. If tokenized assets trade 24/7 but benchmarks like the S&P 500 only calculate once daily, we could see pricing mismatches or delays in index updates.

New indices that track tokenized assets in real time will likely emerge. This shift could affect passive investing, as index-based ETFs may be forced to refresh their prices and holdings more frequently.

The bottom line?

Tokenized securities aren’t just a new product; they represent an entirely new financial system. If this system succeeds, it could unlock trillions of dollars in liquidity, make markets more inclusive, and reshape how we interact with money and investments.

The next 12 to 24 months will be pivotal, as regulators, banks, and innovators race to bring this vision to life. Investors, both big and small, would be wise to pay close attention. The future of finance may be just a token away.

Rest assured, here at HX Research, we're fully prepared to tackle this new opportunity head-on.

In fact, those paying attention may have noticed some of our recent picks have focused on potential early winning companies within this theme.

Stay tuned for more. We’ve got you covered!

HX Daily Redux

Revisiting the Year 2000 Bull Market

This week, all three major US indices traded up. In fact, the Nasdaq and S&P 500 set fresh all-time highs while the Dow came within spitting distance of a new high as well.

Not to be overshadowed, Bitcoin sailed to a new all-time high of over $113K on Thursday.

With everything going up simultaneously, the market is beginning to feel a bit frothy…

With this in mind, we thought we’d revisit a post from last year that harkens back to a well-known historical period of market extremes, the 2000 bull market.

We originally published this piece, "Revisiting the Year 2000 Bull Market: The Forgotten Value Rally," on July 6 last year.

Here is that note. Enjoy!

This week at HX Daily, we are revisiting some stock market environments from years past.

Earlier this week, we reviewed 1995. That year's performance is similar to that of 2024.

Stock market investors hope it ends up with the same finish as that was one of the best years ever for the stock market.

After thinking about 1995, we also considered what would happen in the next few years.

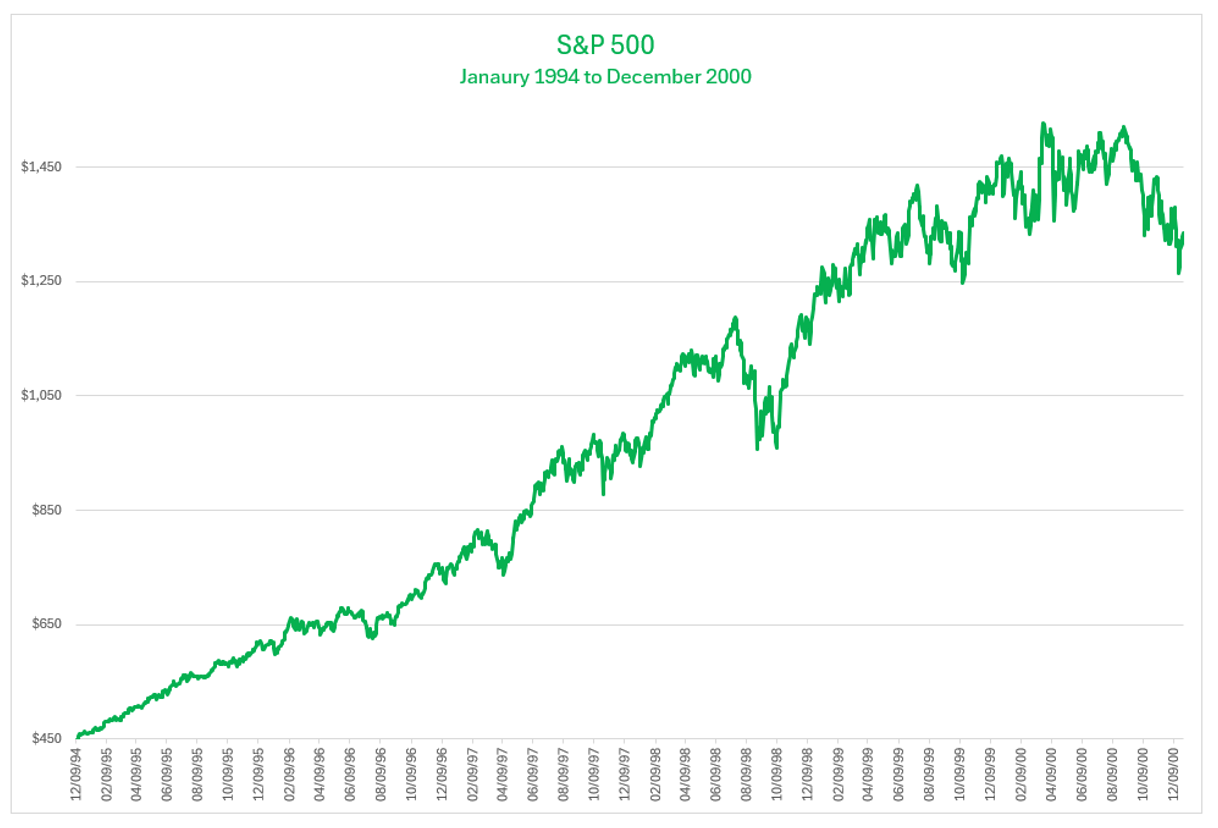

While 1995 was the best performance for the S&P 500 since 1958, the stock market would continue to rip through the end of 2000. It was one of the best periods ever. Here is that chart…

From January 1995 to December 1999, the S&P 500 experienced an incredible +220% or 26% compound annual return. This is double the long-term average return of the S&P 500 over the last hundred years.

One recent topic of conversation has been the relatively high valuations of technology stocks. In fact, they are the highest they have been since the early 2000s.

Many people have talked about this being a "bubble" in technology stocks and see it as a cautionary tale.

We will not argue that technology stocks are not at relatively high valuations. These may even be “bubble” levels.

We note, however, that they can go MUCH higher.

Here is a great chart from one of our investment research firms – Bespoke Investment Group.

This shows the multiple for technology stocks and how the current valuation returns to levels from the early 2000s…

The chart also shows that they can go much higher. During the 1999 Internet 1.0 technology stock bubble, valuations more than doubled from current levels.

That also happened with the expansion in earnings from technology stocks recently. Many of the technology stocks of that era had little or no earnings and were certainly not growing like what we have seen from NVIDIA Corporation (NASDAQ: NVDA).

This is an interesting observation from that period, but we had another one that we wanted to share, as many folks have forgotten about it.

Although technology stocks began to trade off in early 2000, the overall stock market held pretty well.

As technology stocks saw their multiples expand and massive rallies, the rest of the stock market performed poorly.

The spread between the performance of growth and value stocks was the highest it had ever been. Many value-focused portfolio managers (and short sellers) gave up.

There was also a big performance differential between the market capitalization-weighted S&P 500 and the equal-weighted version. Does any of this sound familiar?

Here is another great chart from Bespoke.

It shows the performance differential of the market cap-weighted version of the S&P 500 versus the equal-weighted version from 1999 to 2001.

Remember this period very vividly. Many portfolio managers who posted terrible relative performance in 1999 posted some of their BEST years in 2000.

This was because the high-valuation technology and most speculative stocks crumbled, and the cheaper stocks began to rally.

In the same way that investors had fled the rest of the market to avoid missing out on technology stocks, they now rotated out of them and into the rest of the stock market.

For the full year 2000, the market-cap-weighted S&P 500 was -9.1%, but the equal-weighted version was up more than +8%. The NASDAQ Composite was down more than -39%!

We want that to sink in—the median stock price performance of the S&P 500 was up almost double digits, while stocks on the NASDAQ were cut almost in half.

If we DO experience a true technology stock market bubble, this type of outcome is well off most investors' radar screens.

We are not saying it is likely to happen – either the technology stock bubble or the recovery in the rest of the stock market – but there is precedent.

Few will also remember that it was also really the terrible events of September 11 that plummetted us into a broader economic recession and total stock market Bear Market.

There is historical proof that the stock market can continue to work even if technology stocks deflated.

History can show us the way!

Market Wizard’s Wisdom

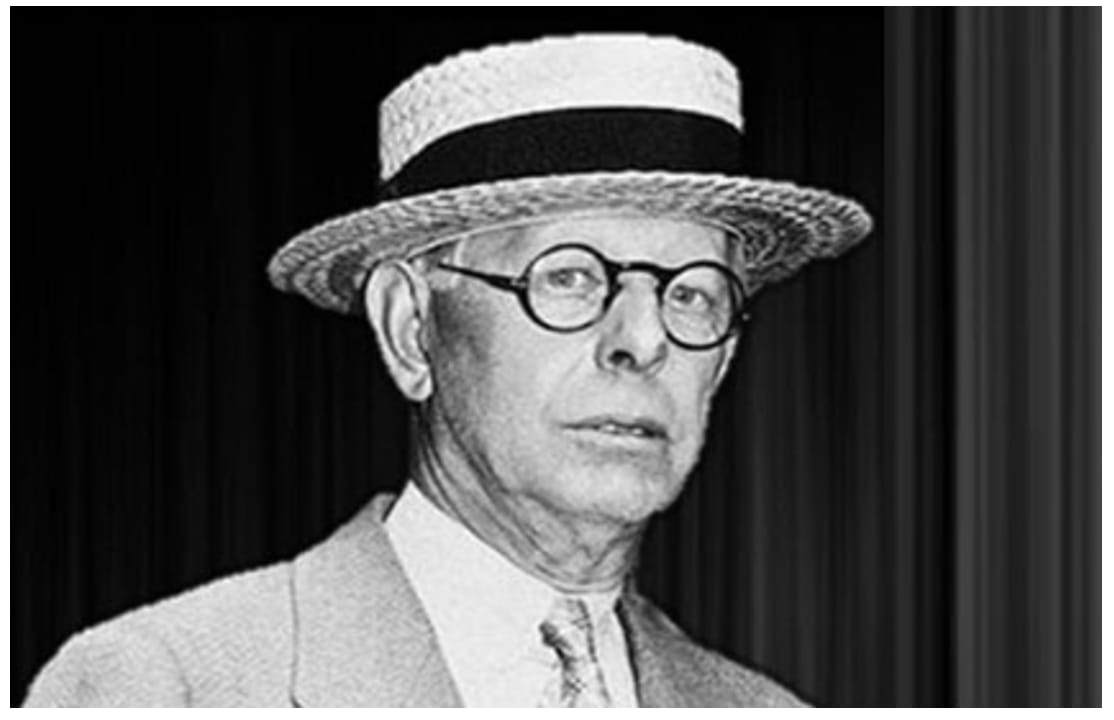

Jesse Livermore

For this week’s “Market Wizard’s Wisdom” we’re revisiting our piece about a phenomenal investor who was born in the month of July way back in 1877.

We originally published “The Wisdom of Jesse Livermore” on July 27 of last year.

Enjoy!

In our last issue, we shared an excellent presentation from our old friend Phillipe Laffont of Coatue Management. Phillipe has built one of the best GROWTH investment firms in the last fifty years, and it was fantastic to have access to his insights.

Phillipe is one of the best in the modern generation of investors, and we encourage you to follow him and learn more.

In today's issue, we want to introduce you to the wisdom of one of the best investors of a MUCH earlier generation – Wall Street legend Jesse Livermore.

Many of you may not have heard of Livermore, but he was a towering investment figure in the early twentieth century.

He was born into poverty in Massachusetts on July 26, 1877, and ran away from home at just fourteen. He managed to get a job as a “board boy” posting stock quotes at the Boston branch of venerable brokerage PaineWebber.

A funny story was that his first “bet” on a stock was not actually buying a stock. He placed an actual BET at a place that would take wagers on stock prices instead of buying and selling the actual stock.

He moved to New York a decade later (at 23) and very quickly took advantage of the turn of the century BULL MARKET for stocks.

Across the next four decades, he would have one of the most dramatic careers in Wall Street's history. He made himself one of the wealthiest investors on Wall Street multiple times but also filed for bankruptcy three times.

Finally, in November 1940, he took his own life by shooting himself with a Colt automatic pistol in the cloakroom of The Sherry-Netherland Hotel in Manhattan – one of his favorite spots.

We encourage you to read more about him, and below are a handful of great timeless quotes from him about investing…

"Don't trust your own opinion and buck your judgment until the action of the market itself confirms your opinion."

This is one of the core tenets of our investing strategy. We are seeking confirmation from the market that it is interested in the stocks we are investing in and trading.

Being right about a company's fundamentals but not having the stock confirm them is just WRONG.

“Never buy a stock because it has had a big decline from its previous highs.”

This is quite a simple rule, but many investors start looking for stocks by looking for the ones that are down the most. Those could be good stocks, but we prefer to start by looking for the ones that are UP the most and have pulled back.

“Big movements take time to develop.”

Those kinds of returns, though, rarely happen in a day, a week, or a month. Sometimes, they take YEARS. Patience is your most crucial investment weapon.

“It is not good to be too curious about all the reasons behind price movements.”

THIS is one of his most potent quotes!

It is incredible to us how much time and energy investors waste trying to "explain" price movements instead of just coming up with a plan to handle or harness them.

Stop looking for the reason for the move and figure out how to make money off it!

“It is much easier to watch a few than many.”

Our regular readers know we often return to the SAME STOCKS in our trading.

It is too complicated (and pointless) to have an opinion on EVERY stock out there.

Figure out a group of stocks where you understand the trading sentiment and fundamentals and determine how to make money off those consistently.

“The human side of every person is the greatest enemy of the average investor or speculator.”

We talk about this ALL THE TIME. Your greatest challenge as a trader or investor is your human psychology.

Figure out these biases and how to eliminate them from your process, and you will be more successful!

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply