- HX Daily

- Posts

- HX Weekly: September 29 - October 3, 2025

HX Weekly: September 29 - October 3, 2025

Things to Keep in Mind, the “Dead Decade” and More

Hello reader, welcome to the latest issue of HX Weekly!

Each Friday, we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

Things to Keep in Mind

On Tuesday, during our morning reading, we came across an email from Sean Ring, one of Enrique’s colleagues at Paradigm Press.

Sean writes an awesome free newsletter called The Rude Awakening. His unique background as a former banker and financial educator brings a worldly perspective to his writing that we really enjoy.

You can sign up for his Rude Awakening newsletters here and follow him on X here. We highly recommend doing so!

That said, we liked his note from Tuesday so much, that we’re republishing it here in its entirety

We hope that you enjoy it as much as we did.

**********************

Keep These Things In Mind When Riding the Wave

Gold, silver, and the miners were up yesterday, although the miners didn’t have as big a day as I would’ve liked. No matter. Today is always another day.

In fact, if things keep going the way they’re going, we’ll see the highest-ever monthly and quarterly closes for gold and silver today. That’s not a sign of bearish behavior, to say the least. The algos will almost certainly jump on that bit of information to stack more ingots.

This morning, I read my friend and colleague Enrique Abeyta’s latest article titled “The Trading Secret Every Blackjack Pro Knows.” I recommend it to you highly. And it has inspired me to take a break from the charts for a day to address the mental side of trading.

So, I’ll save the charts for tomorrow’s monthly asset class report. Because if your trading or retirement account is up as much as mine is, you may be thinking things like, “When do I get off this train?” Or “how much is enough?”

Let’s enlist some of the world’s greatest investors and traders to help us answer those questions.

Charlie Munger

“Invert. Always invert.”

Charlie Munger was Warren Buffett’s right-hand man at Berkshire Hathaway for what seemed like forever. But it was Munger’s urging that led Buffett to stop buying cheap companies and to buy good companies at reasonable prices. Like figuring out Larry David was the true genius behind Seinfeld after watching a few episodes of Curb Your Enthusiasm, Charlie Munger was the intellectual power behind Buffett’s throne.

Instead of thinking about what you can do, start thinking about the things you need to avoid. (Taking big losses would be at the top of my list.) Here’s Charlie explaining this concept himself, using it when he was a weather forecaster in the Air Force during World War II (bolds mine).

I invert all the time. I was a weather forecaster when I was in the Air Corps, and how did I handle my new assignment as a weather forecaster in the Air Force? A lot like being a doctor who reads X-rays. It's pretty solitary. You're in the hangar in the middle of the night, drawing weather maps, and you're clearing pilots. But you're not very much interfacing with a bunch of your fellow men, so I figured out the minute I was actually making weather forecasts for real pilots. I said, “How can I kill these pilots?” Now, that's not the question that most people would ask. But I want to know what the easiest way to kill them would be, so I could avoid it. And so I thought it through in reverse, that way, and I finally figured it out. I said there are only two ways I'm ever going to. I'm going to get him to icing his plane can't handle, and that will kill him. Or I'm going to get him someplace to run out of gas before he can land because all the airports are sucked in, and I just was fanatic about avoiding those two hazards.

Figure out what you don’t want to do, and then be fanatical about not doing it.

Ray Dalio

“You can scratch the car, but you can’t total the car.”

Ray Dalio founded and ran Bridgewater Associates for decades before stepping down recently. For a long time, Bridgewater was the largest hedge fund in the world as measured by assets under management (AUM).

“Pain plus reflection equals progress.” Dalio emphasizes the importance of allowing yourself and, if applicable, employees to make mistakes and use them as learning opportunities. Dalio discusses how he remembers his mistakes more than his successes, as he has learned a great deal from them.

I know how difficult this is to do with your own money in your own trading account. But you really have no choice in the matter anyway. Think of those losses as the tuition fees you pay to learn the craft of trading. I paid a lot of tuition fees in my life. Though, of course, I wish the cost were less, I’m happy I learned.

Ed Seykota

“The trend is your friend except at the end when it bends.”

Ed Seykota is a private trader who allegedly turned $5,000 into $15 million in 12 years, a feat thought impossible at the time. He’s a legend among trend-following traders. These traders ride their winners for as long as possible and cut their losing trades as quickly as they can.

His point is to hang onto winners until you know the trend has reversed. If you note, in the unofficial Rude portfolio, we’ve hung on to most of our trades for a year now. (In this bull market for metals, we haven’t had to cut too many trades.)

It’s essential to maintain your composure, especially when the market becomes volatile.

George Soros

“It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong.”

Before he was a lunatic left-wing activist funding destruction all over the planet, George Soros was simply the greatest trader who ever lived. And this quote is the most important thing he ever uttered. Too many people would rather understand the market than use it to make money. Soros was all about the money.

He’s the only trader I’m aware of to break a central bank and inadvertently create the prime services industry in the process. To this day, you can’t mention his name around the Bank of England. As a bonus, the trade led to the UK's exit from the Exchange Rate Mechanism, a precursor to the euro.

Risk management is at the heart of making money. Risk too much and lose, and you'll blow up your account. Risk too little and win, and the victory is hollow. Soros knew when to pile into trades and when to take money off the table. No one has ever done it better.

Print out his quote and put it somewhere so you read it every day of your trading life.

Stanley Druckenmiller

"I like putting all my eggs in one basket and then watching the basket very carefully."

If you watched the Soros video from the above section, you’d have noticed a young Stan Druckenmiller, who was George Soros’s right-hand man during the Bank of England trade. (Another Soros lieutenant was the current U.S. Secretary of the Treasury, Scott Bessent.)

I love that Druckenmiller doesn’t preach the diversification dogma that keeps so many investors from making the kind of returns they should.

The entire Rude portfolio is in the miners, and I couldn’t be happier with the performance. If we kept some in other equities, crypto, or, heaven forbid, bonds, we’d be the poorer for it.

But we need to watch it carefully, lest we miss our profitable exit opportunity.

Wrap Up with Clint Eastwood

“If you want a guarantee, buy a toaster.”

Ok, just one famous actor is on the list. Eastwood is here to remind us that nothing in life is guaranteed and that we need to take the good with the bad.

But never, ever lost your faith.

Mistakes are a learning opportunity. Managing risk is a learned process. Staying with the trend takes practice. Watching your portfolio every day develops discipline. And piling into good trades when they’re ready to pop develops assertion.

It’s all worth it in the end.

Good hunting and good luck!

HX Daily Redux

Market Mediocrity – The Dead Decade?

Sometimes at HX Research, we like to look back and see what we were thinking and writing about a year ago.

If you can believe it, the investing world was buzzing with conversation in late October 2024, not about the bull market, but rather a report authored by Goldman market strategist David Kostin.

The thesis of the report was that stock market returns over the next decade would be far lower than what we’ve grown accustomed to.

This topic has resurfaced recently, so we thought this piece deserved a fresh read.

Enjoy!

Last week, Goldman Sachs put out a report that turned many heads.

Goldman market strategist David Kostin authored the report. David is an old friend whom I have known for more than two decades. We collaborated on and debated many market issues back in the day.

In his report, he suggests that in the next decade, the stock market might only see an average +3% return. After taking into account anticipated inflation of +2%, this would mean only a +1% "real" return.

Basically – he argues the stock market will be FLAT for the next 10 years!

This is a BIG change from the last decade, where annual returns have averaged +13% per year.

This is what David said in his report…

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” he writes.

David makes some well-thought-out points.

First, he argues that the stock market's valuation is at historic highs on several measures. This is true.

Historically, from these levels, the forward returns of the S&P 500 are muted. This is a common argument.

Second, he points out that concentration with a handful of large stocks is related to the first point above. Historically, this level of concentration around a small group of expensive stocks has led to future underperformance.

Third, he believes the economy will experience more volatility in the coming years, and corporate profits will fall.

Both are good "mean reversion" arguments. Meaning that if these return to historical averages, they will need to go down.

Finally, they believe that interest rates are likely to be higher than they have been in the last ten years. This would argue for a lower stock market valuation than current levels.

What are our thoughts?

We think David makes some good, sound arguments. This outcome is possible.

Do we, however, think it is “probable”?

His arguments are based on the concept of "mean reversion" we mentioned above. This is the idea that, eventually, metrics return to their long-term averages.

This concept underpins our highly successful trading strategies.

The problem with returning to historical levels is that the world changes.

In the 1980s, most of the largest companies in the S&P 500 were energy companies. These are capital-intensive, highly cyclical, and volatile businesses, and they deserve low multiples.

Compare that to the “The Magnificent Seven” and their business models. These are some of the best businesses in human history. They have much higher margins and better returns.

There is a compelling argument that they DESERVE these higher multiples.

Looking at the gross margins for the S&P 500 companies, we also see that they are 10% higher than historical levels. One argument could be that this is unsustainable.

The other argument is that they are higher because business is much more efficient today than ever before. Before we even think about the impacts of artificial intelligence, think of the incredible increases in productivity we have seen in the last few decades.

The world changes. We are not saying this time is “different,” but we must acknowledge that the world and the economy are evolving. Metrics will evolve with it.

Another part of our view is that Kostin's bet is a very low probability.

Here is a chart from Ben Carlson of A Wealth of Common Sense and Ritholtz Wealth Management…

The chart shows that the S&P 500 annualizes at a +3% return over a 10-year period only 9% of the time.

It IS possible that this happens, but it is improbable. Eventually, we think it will happen, but it is a low-probability bet. Those are not the kinds of bets we like to make.

Our most important takeaway about David's view is that we really don't care!

Our TRADING and INVESTING strategies at HX Research have been created to make money in ANY kind of market. We have demonstrated their success over the last three decades by making money in every major down market.

If you have the right process, you should be able to make money regardless of whether the stock market is +3%, -13%, or +33 %.

Focus on your process, and you will see success.

Market Wizard’s Wisdom

Ken Griffin Is Full of Sh*t

For this week's "Market Wizard's Wisdom," we're revisiting a note that our own Enrique Abeyta originally authored for the Paradigm Press newsletter Truth & Trends.

If you don’t already receive Truth & Trends, we highly recommend it. It’s free, and Enrique and other amazing authors contribute original pieces frequently.

The piece we’re sharing today was originally published in June 2025.

Enjoy!

Ken Griffin is one of the richest men in the world.

He’s the Founder and CEO of Citadel LLC, one of the most successful hedge funds in history.

Recent purchases of his include…

$45 million for a dinosaur skeleton…

$43 million for a first edition of the U.S. Constitution…

And half a BILLION dollars for just two pieces of art in 2016!

Griffin was recently interviewed by Bloomberg and shared his best advice on how regular folks can make solid returns.

His advice?

You can’t. Don’t even try.

Griffin says that retail investors should rely on “professional investors” to manage most of their money.

He is dead wrong. With the right combination of hard work, knowledge and discipline, anyone can succeed as an investor.

Let’s talk about it.

The Numbers Don’t Lie

As for Griffin, apparently being smart and super rich doesn’t make you good at math.

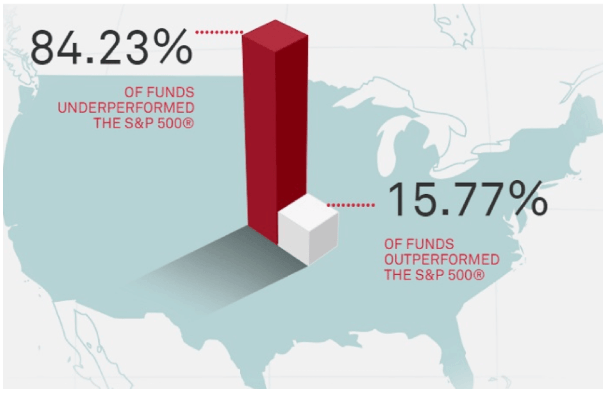

Here is a good graphic showing how the professionals actually perform compared to the broad market.

This analysis is over a five-year period. The numbers over a 15-year period are even worse, with a little bit over 5% of funds outperforming.

Griffin would probably argue that hedge funds do better. But the facts don’t back him up there either.

Not only have the hedge fund indices — even his vaunted Citadel — underperformed the S&P 500 heavily over time!

Griffin’s returns aren’t amazing. He makes his real money not his returns, but on the amount of assets he has under management.

Keep in mind, you have to jump through a ton of hoops and pay massive fees to get the “privilege” of investing with him and his billionaire pals.

Here is what he said:

“It’s very important to understand that your likelihood of beating the pros as a novice investor is low. It’d be like asking me to go out there and play football on an NFL team. One of the mistakes that investors will make early in life is they don’t take a step back and think about the fact that there are thousands and thousands of people for whom picking stocks is a full-time job. Now, this doesn’t mean that retail investors aren’t successful, but I think that retail investors need to always keep in mind that for a significant portion of their portfolio, they should probably entrust it to professional investors for whom this is a full-time job.”

Part of this is true. Factually, professional investors spend a lot more time than retail investors on stocks.

The data appears to support the idea that it doesn’t matter, as the vast majority of both underperform the stock market indices.

Why then should you pay those hefty fees to these professionals? You shouldn’t!

Instead, you should empower yourself through intelligent research, finding great resources and a disciplined process.

You Are Not Doomed to Fail

An analogy I like to use is the restaurant business.

You don’t need a degree or training to open a restaurant. The market is huge, and anyone with a little bit of capital can start one.

The data shows, however, that the vast majority of restaurants fail.

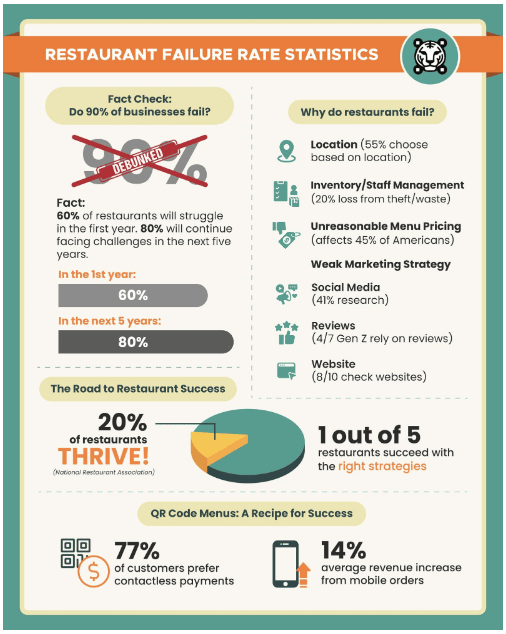

The myth is that 90% fail in the first year, which isn’t exactly true. Here is a good graphic showing the actual numbers.

Interestingly, the number of restaurants that succeed is about the same as the number of investors who consistently outperform the stock market.

You could make a similar graphic for investing. The short list of items on the “why investors fail” list would be:

Lack of trading discipline

Valuing narrative over price

Ignoring technical analysis

Too much emphasis on valuation

Not enough selectivity

Over-diversification

For anyone willing to do the work — learning a great process, finding great resources and remaining disciplined — great rewards await in investing.

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply