- HX Daily

- Posts

- HX Weekly: December 29, 2025 - January 2, 2026

HX Weekly: December 29, 2025 - January 2, 2026

2025 Predictions Year End Review, 2026 Resolutions and Celebrating Charlie Munger

Hello reader, welcome to the latest issue of HX Weekly!

Each week we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

My 2025 Prediction Report Card

Last year in our free publication with Paradigm Press Group we presented our top predictions for 2025.

In today’s issue of HX Weekly, we review those predictions and how they performed. The majority (80%) were pretty spot on, but the last one – not so much!

Check out our review along with some insight into our thinking going forward.

Earlier this year, I shared a few of my top predictions for 2025.

Now that the year is drawing to a close, I thought it would be a good time to revisit them and see how I did.

My first set of predictions was about stocks and crypto. Right off the bat, I have to say that I did pretty darn good!

Well, except for one…

Read on below for my 2025 stock market predictions and an update on just how right (or wrong) I was.

#1: The Mag 7 Will Outperform Again (Except Nvidia)

With the Mag 7 stocks leading the market for two straight years, many people anticipated they would underperform in 2025.

But I predicted that most of them would continue dominating this year and outperform the broad market.

I also predicted that Nvidia, one of Wall Street’s most beloved stocks at the time, would be the exception and underperform.

So, how did they do?

Well, the year isn’t over yet. But here’s a snapshot of how the Mag 7 are doing right now.

As a group, the Mag 7 are up a little over 20% on the year. That’s better than the S&P 500, which is up about 15%.

Clearly, it’s been another strong year for this group of stocks.

The biggest difference between 2025 and the two years before is the spread between the winners and losers.

In previous years, there had been one huge winner — Nvidia. The rest were all up solid double digits.

This year, the leader is Alphabet with a solid 60% return. But many of the others aren’t up by much at all.

In fact, four of the seven have underperformed the S&P 500.

Without a late run by Tesla at year-end, only two of them would have outperformed the broad market.

So my prediction was technically correct, even if Mag 7 outperformance looked different from years past.

I’m okay with that; right is still right. I give myself an “A-” on this one.

#2: Small-Caps Will Continue to Struggle

This is another one where I went against the consensus.

Given the long stretch of underperformance by small caps for the last few years, many investors expected them to begin outperforming.

I disagreed and said that the Russell 2000 small-cap index would underperform once again.

This one is coming down to the wire. But as of this morning, the Russell 2000 is up roughly 13%. That’s marginally less than the S&P 500 and quite a bit behind the Nasdaq.

But again, right is right.

I’ll give myself a good passing grade, but with a few reservations. Let’s call it a “B+.”

#3: Interest Rates and Inflation Won’t Matter

There’s a lot of talk about interest rates almost every year. And in recent years, there’s also been a huge focus on inflation.

I thought both of those concerns were very valid in 2022 when the Fed was actively working to fight the inflation that soared post-COVID.

But it’s been my view that after the period of rapid rate increases, neither of these would matter very much.

The reason is simply that I didn’t think either of them would do very much.

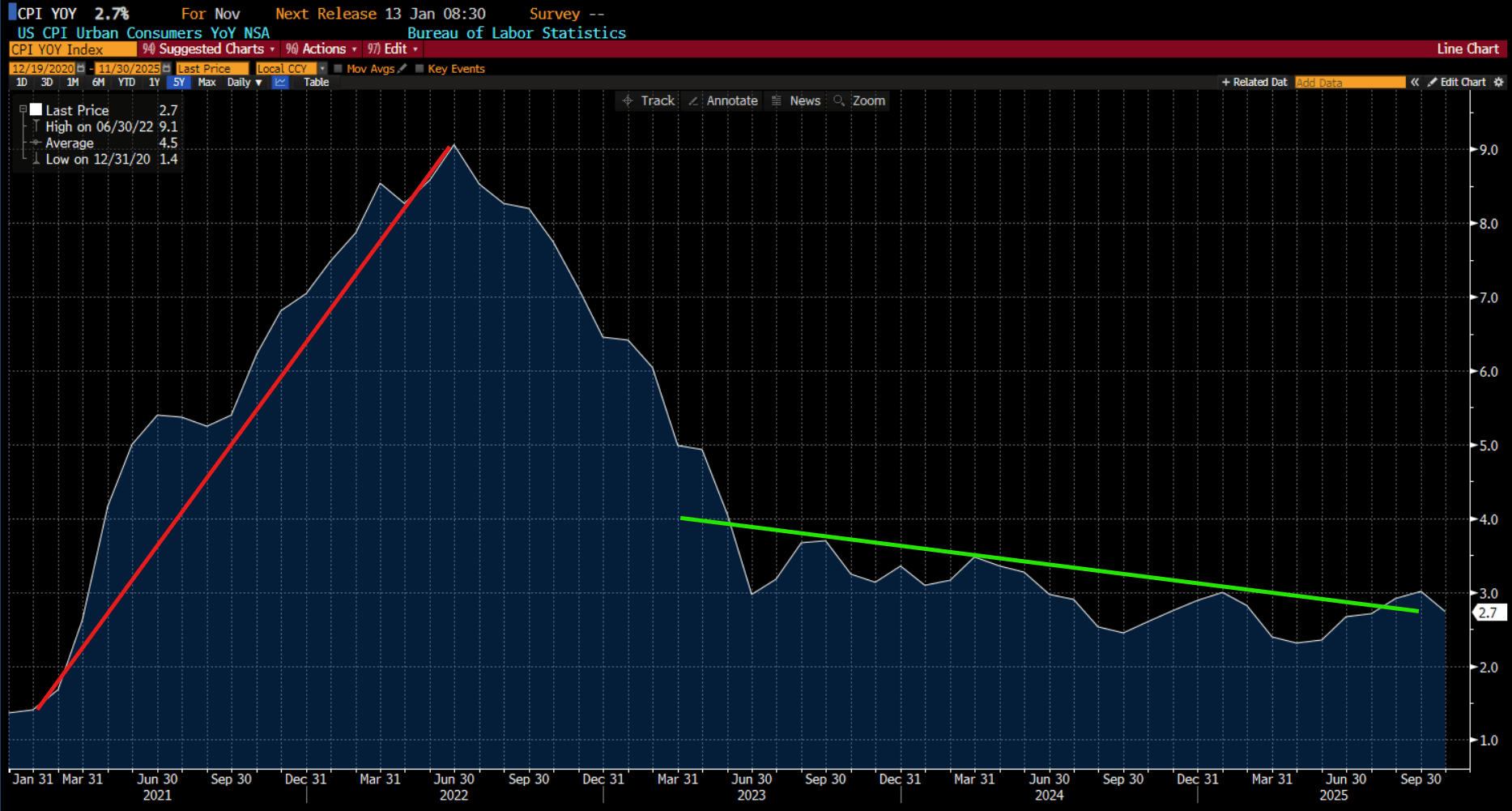

Here are the charts of the yield on the benchmark U.S. Government 10-year bond and the CPI.

Interest Rates: U.S. Government 10-Year Bond Yield

Inflation: Year-Over-Year Change in Consumer Price Index

These charts look very similar to how they did last year. The only difference is that the green lines are longer.

I would also note that both rates and inflation appear to be trending lower now.

With the economy posting fine growth and the stock market higher, this prediction gets a solid “A.”

#4: The Stock Market Goes Up a Lot (or a Little)… But NOT Down

This was another one where folks were predicting a reversion to the mean.

The stock market was up more than 20% in both 2023 and 2024. How could it be up again in 2025?

Well, trends in markets tend to persist, and this one did as well.

Here is a table from Charlie Bilello that I shared last year.

And here’s what I wrote:

“On the chart, you can see that there’s a high correlation between growth in earnings at the S&P 500 and price performance. Valuation didn’t matter.

Steady interest rates, inflation, and commodity prices combined with an accommodative monetary and fiscal policy indicate earnings will likely grow over the next year.

Maybe they grow more or less than current expectations, but I expect them to grow. If they grow, then stocks go up.

The surprise may be that they only go up slightly (say, less than 10%) as we have a choppy stock market.

Or maybe they go up a lot (greater than 30%) as we revisit the melt-up environment of the late 1990s.

Either way, I don’t think the stock market will drop in 2025.”

Well, earnings grew nicely in 2025. And we had plenty of mid-year chop, so this was pretty spot on.

The stock market wasn’t necessarily up “a lot” or “a little.” Instead, it was just right. I think this one is an “A-.”

#5: Bitcoin Hits $250K

Hey, four out of five ain’t bad, right? With Bitcoin trading below $90,000, this one was far off.

I’ll have more to say on where I think Bitcoin is headed in 2026 soon. But for now…

This gets an almost failing grade. Not quite an “F” since Bitcoin didn’t completely crash, but a solid “D-.”

I said this when I originally shared these predictions in January, but it bears repeating…

I may be right, or I may be very wrong. This year, I was both. But never let it be said that I’m afraid to take a stance on the market!

I look forward to sharing my predictions for 2026 soon. So stay tuned.

HX Daily Redux

One Daily Habit Changed My Life Forever

New Year’s resolutions are the BIG topic this week and today we share our slightly different take on how approach them in trading and investing.

EVERY DAY should be a day for a resolution in our view. Hope you enjoy the note!

Trust the process. Review positions daily. Stick to your stops.

Every January, traders make the same resolutions. And by February, most of them are already broken.

Now, I don't mean to start the year on a negative note. (Happy New Year, by the way!) But I do want to be honest with you...

The most successful traders I know don't wait for New Year's Day to get in the right mindset. They do it every single day.

After 30 years in the markets, I've developed a daily process that helps me stay on top of this. And it’s transformed both my trading and my personal life.

Today, I want to share that process with you.

Why New Year’s Resolutions Don’t Work

When you take a step back, the concept of the “New Year” is pretty strange.

Sure, the first day of a new year is obviously important. But there’s nothing especially significant about January 1 from an astrological or scientific perspective.

Starting a new year on the winter solstice (the shortest day of the year) would make a lot more sense. The days start to get longer after that, which seems pretty special to me.

January 1 was established as the start of the year by Julius Caesar in 45 BCE because the first new moon after the winter solstice fell on that date.

The fact is that the day we celebrate the new year is a completely manufactured concept, yet it influences so much of our lives.

Now, you’ve probably heard me talk about year-end seasonality before. To recap, many professional money managers are compensated on their year-end performance.

This motivates them to act in particular ways late in the year, which creates statistically significant patterns we can trade to our advantage.

Then January rolls around, and it’s time to reflect and reset. We set New Year’s resolutions, make goals, and think about how we want to improve our lives and the lives of those around us.

It’s a noble idea, but the fact is the vast majority of us fail at accomplishing these resolutions.

I think that’s because just like there’s no logic behind the calendar date for the new year, taking just one day to examine our goals doesn’t make much sense either. It sets us up to fail.

It may sound strange, but trading is something that resets constantly. When it comes to actively managing your portfolio, every new day is the start of the new year.

In other words, you need to make good on your resolutions every single day to be successful.

The Daily Practice That Made Me a Better Trader

About a decade into my career as a professional investor, I began to develop a process where I would review each of my positions every day.

I’d look at them as if they were brand-new positions and ask myself whether I would still put them on today.

This was an extremely useful exercise that helped me become a more successful trader.

Over the next decade, I built on my process even more by automatically reexamining my positions through this new prism.

Instead of analyzing every single position myself, my proprietary software — the same one I use today — would tell me the conclusion.

This put my trading into overdrive!

A few weeks ago, I was telling our awesome publisher Matt Insley about my process and how I now use it in my personal life every day too.

After waking up in the morning and preparing for my day (hygiene and prayer), I sit down and close my eyes for 10 minutes to think about my top priorities.

In my head, I go through the list of both the short-term and long-term goals that I want to accomplish.

Then I prioritize what are the single steps I need to do today to move those goals forward. Finally, I visualize what would be my perfect day.

As I told Matt, right after I think about how I can improve the lives of my family, my number one goal is how I can make our readers — yes, you! — money.

I think about how I can help teach you sustainable trading processes and share actionable ideas.

This process isn’t something that I do just at the start of the week, the start of the month, or the start of the year — it’s EVERY SINGLE DAY.

It has been 30 years since I began my career as a professional trader. If I could think of one piece of advice that I would give folks starting out on their journey, it would be this…

Treat every day as if it were New Year’s Day, and come up with a process to get better every single day.

Again, this applies to both your personal life as well as your trading decisions.

Market Wizard’s Wisdom

Remembering Charlie Munger

Yesterday (January 1) would have marked Charlie Munger’s 102nd birthday! In honor of his birthday, here are a few notes we have written about Munger in recent years.

My own relationship with Charlie Munger is an interesting one.

I have always been familiar with his incredible success as an investor with his partner, Warren Buffett. My career and training were built on more trading-focused strategies, so I had never really spent much time learning more about him.

If anything, I felt that his more bombastic comments lacked an open-mindedness that I think is important to have as an investor.

Interestingly, that view hasn't changed, but I have dived into learning more about him in the last few years, and I am BLOWN AWAY!

While his controversial, off-the-cuff comments may have put me off, his wisdom, breadth, and insightfulness are extraordinary.

As we have learned more about the quotes of the greatest investors in history, Munger stands out as the #GOAT (Greatest-of-all-Time) regarding his pithy insights.

In honor of the passing of the most significant investment quote master of all time, we thought we would share some of our favorites today. Enjoy!

“A great business at a fair price is superior to a fair business at a great price.”

This is our favorite Charlie Munger quote of all time and makes a point that we have made Buffett and him. We think they are the greatest GROWTH investors of all time, and value is only a tiny part of it.

Every single one of their most successful investments went up not because it was cheap but because it grew.

If there is ONE piece of advice you could take from Munger – this is it.

“If something is too hard, we move on to something else. What could be simpler than that?”

This is a piece of advice that is hard for investors to embrace sometimes.

It seems “smarter” to work on something complicated. That does not mean it is more likely to make you more money!

One of our rules is that if we can't explain an idea to one of our non-investor friends or family, we move on to the next idea that is easier to understand.

Had we done this earlier in our career, we would have made a lot more money and saved many headaches!

“We both (Charlie Munger and Warren Buffett) insist on a lot of time being available almost every day to just sit and think. That is very uncommon in American business. We read and think.”

This is not just great advice for trading and investing but also for life.

In addition to my morning prayers, I like to take a period (10 minutes) where I visualize the tasks I want to accomplish and what my "perfect day" would be like today.

This allows me to prioritize and attack the day with a plan.

“Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.”

Most information used to be available in books, but now it is mostly online.

Some investors brag about how they avoid specific sources of information to be able to tune out the "noise." If you need to avoid being distracted by information, the problem is with your process, not the information.

We read everything we can that could have valuable information about our investments. Sometimes, knowing the wrong information that is popular is more valuable than knowing the correct information that is unknown.

“Avoid crazy at all costs.”

This reminds me of another statement we heard from Munger once but couldn't find the quote – "I don't know how I would react in a period of distress, and I do everything in my power to never find out.”

I don't know about you, but I wish someone had told me that when I was twenty years old; I would have taken it to heart. I also would have made much more money and saved me much stress.

“All I want to know is where I'm going to die so I'll never go there.”

This one pretty much sums Charlie up in one simple quote!

Rest-in-Peace Charlie Munger and THANK YOU for your wisdom.

Poor Charlie’s “Mental Models”

Many (most) of the smartest investors are not great at communicating their wisdom. Their quotes are often too complicated or obtuse.

There are few, however, that stand out for the simplicity of their wisdom.

It won’t surprise you to learn that one of those is the great Charlie Munger.

Munger’s ability to generate a pithy – and incredibly insightful – quote is incomparable.

Recently, we read a piece by our colleague Sean Ring of The Rude Awakening, and he introduced me to Munger’s “mental models.”

As Sean says, these are “…guiding principles and ways of thinking that he’s (Munger) curated from a broad spectrum of disciplines. Munger’s approach isn’t about memorizing facts or executing rigid strategies but constructing a ‘latticework of mental models’ that integrate knowledge from psychology, economics, biology, and other fields to make better decisions.”

We loved the mental models Sean shared in his piece, and we are going to share some of them with you today.

By the way, you can sign up for Sean’s great free email newsletter here.

Here are Munger’s “mental models” …

1. Inversion

I quickly recognized most of the mental principles that Sean shared. However, when I read the title of this one, I had no idea what he was talking about.

The idea here is that sometimes, the best way to figure something out is to think about it backward. Don't think about what you are trying to do but what you are trying to avoid.

When it comes to investing, instead of thinking about what makes a “good” investor – focus on what makes a “bad investor.” Then work to eliminate those characteristics from your process.

In our three decades as professional investors, we have almost never seen someone run a big fund without a good process for making money. Most of them, however, did NOT outperform the markets.

The reason was because they didn't eliminate their bad habits. Their ideas were good, but their processes around them were poor.

Start by identifying potential failures and working to remove those elements from your strategy. This is probably Munger's most powerful insight.

2. Opportunity Cost

Most investors are familiar with this concept.

The idea is that in addition to the straightforward cost of doing something, there is another cost—the "opportunity cost"—incurred by NOT doing something else.

It is a very well-known concept in economics.

What we think is hugely underappreciated is HOW important this is for your process.

Investors understand it is important but don't make it a priority. We constantly push SELECTIVITY.

Too often, investors focus on making a good return when they could be focused on making a great one. There is only so much time and capital; you should be ruthless in deciding where to allocate them.

3. Circle of Competence

This is a favorite of Munger's and was a big part of his life. The key is knowing both what you DO know and what you DO NOT know.

Figuring out where you don't have the expertise or the ability to have insight is essential to avoid mistakes.

Also, it is crucial to have the humility to go to others with that competence when you need it.

4. Confirmation Bias

In the past, we have often written about different psychological biases that influence (negatively) our TRADING and INVESTING. This is the most powerful one.

We are mentally programmed to seek information that supports what we believe or want to believe. We don't like hearing contradictory information.

This bias is not just in finance but in all areas of life.

One of the keys to success is becoming comfortable with being UNCOMFORTABLE.

Seek out the arguments for why you are wrong. Like the idea of "inversion,” embracing critical and negative feedback is a key to growth.

5. The Lollapalooza Effect

Munger coined this term. It describes a situation in which multiple mental models, tendencies, or biases work together to create extreme outcomes.

These outcomes could be good or bad. These are feedback circles that are built into human psychology.

This concept is also related to George Soros' "reflexivity" concept, which we have written about in the past. You can read that note here.

These human feedback loops are some of the most powerful forces in all of finance and human activity.

In case you are wondering, the word “Lollapalooza” is a 19th -century American slang word that refers to something unusual, extraordinary, or exceptional.

6. Second-Order Thinking

This is the concept that when we consider the impact of an action or decision, we often only consider what is likely to happen next. It is difficult for us to consider the greater ramifications.

This can have significant impacts on trading and investing.

A change in commodity prices might impact one of your holdings in a certain way. Looking beyond the initial reaction might lead to the conclusion that it affects it in the exact opposite way.

Getting this wrong can lose you a lot of money.

We spoke about a version of this concept in our recent note about legendary investor Howard Marks. You can read that note here.

7. The Map Is Not the Territory

We had never heard this saying before, but Munger is making the point that no matter how well thought out a model might be, it doesn't represent reality.

No matter how sophisticated the model is, we cannot 100% capture the complexity of the real world.

A dangerous outcome related to this insight is what is called "false precision."

When we make decisions based on the result of a "model" without accepting it, we may be wrong. More data does NOT mean more accuracy.

8. Mr. Market

This is a clever term coined by the father of value investing – Benjamin Graham.

"Mr. Market" is a fictional character Graham created to illustrate that markets are emotional and volatile by nature. After all, they are made up of humans!

Much of Graham's (and Munger's) work is based on the idea that fundamentals drive ultimate stock prices. We don't always agree, but the concept of "Mr. Market" was their acknowledgment of human emotion's role in asset prices.

This is a powerful concept in psychology.

We feel better about making a decision or taking an action when we see our peers doing the same. This is the key to herd mentality and the creation of asset bubbles.

When we see everyone else buying a winning growth stock (that is going up), we feel good about buying it as well. Regardless of what our analysis might tell us.

This brings up the old stock market adage about money management – “No one ever got fired for buying IBM.” Today’s version might be NVIDIA instead…

10. Occam’s Razor

This is one of our favorites. "Occam's Razor" states that when given a range of potential explanations for something, the simplest and most straightforward is the most likely.

We think this is true in most things in life.

It is also one of the more challenging insights for "sophisticated" investors to accept. The most straightforward answer seldom sounds the smartest.

Many (most) professionals are more interested in sounding smart than being right.

Remembering "Occam's Razor" when doing your analysis can give you a leg up on them!

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply