- HX Daily

- Posts

- HX Weekly: January 12 - January 16, 2026

HX Weekly: January 12 - January 16, 2026

Volatility Did Its Job, The Federal Reserve and The "Money Game" Master

Hello reader, welcome to the latest issue of HX Weekly!

Each week we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

The Year Volatility Did Its Job

Let's look back at 2025, the volatile market year that just ended.

We read a great article this week on A Wealth of Common Sense by Ben Carlson that inspired today’s piece.

Ben is one of our favorite writer’s and you should definitely give him a follow and check out his site.

The past year was another reminder that volatility is not a malfunction in the system. It is how the system works.

And now, let’s get to the content.

Volatility Feels Like Failure — Until It Isn’t

As we frequently observe in our writings here at HX Research, markets have a way of replaying the same lesson under different headlines.

While each cycle feels unique in the moment, the underlying pattern remains remarkably consistent. This was certainly true in 2025.

Early in 2025, confidence cracked.

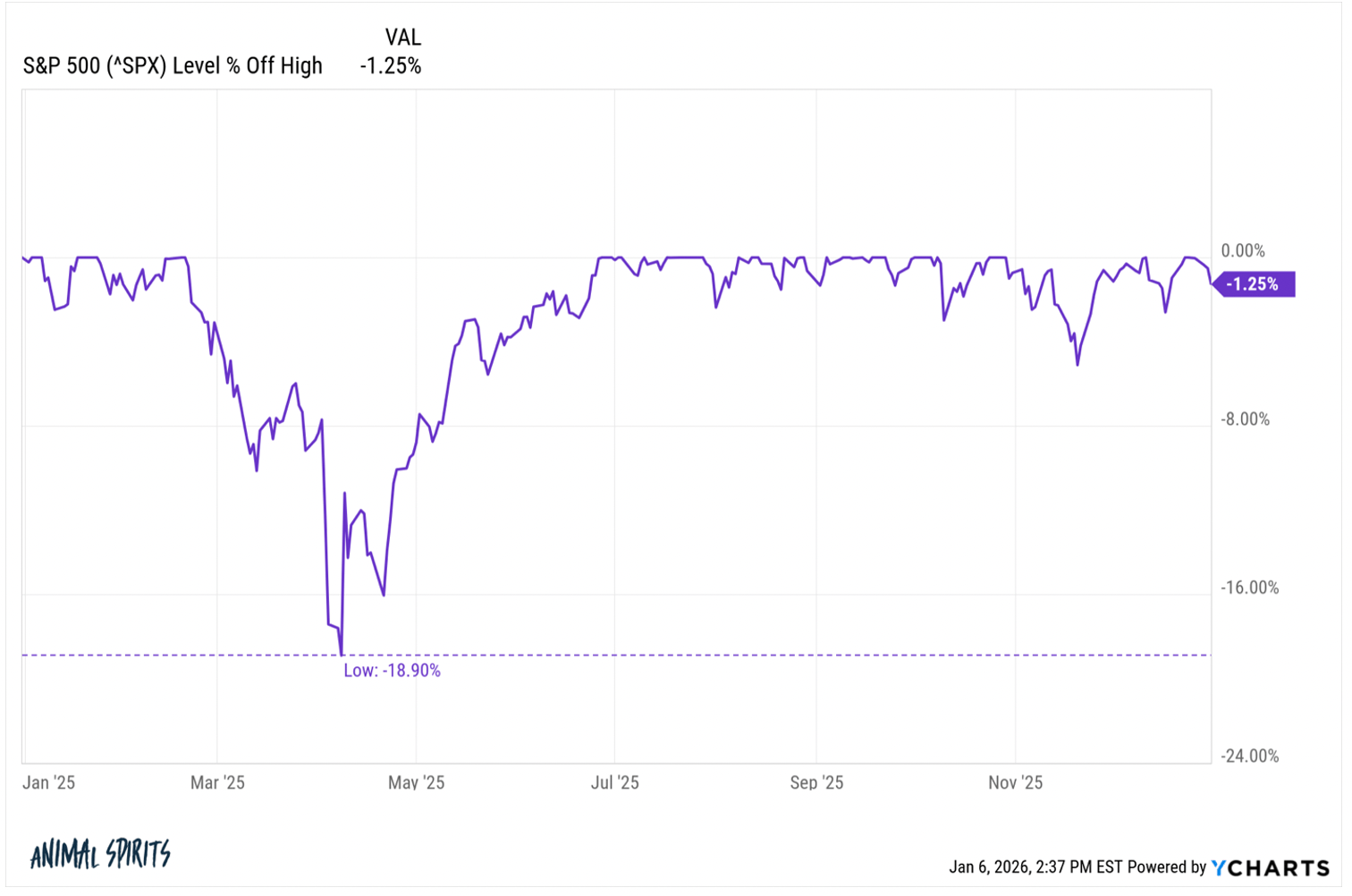

From its highs, the S&P 500 slid nearly 20%, bottoming out around the so-called “Liberation Day” tariff lows in early April.

You can see that decline highlighted in the chart below.

At that point, the index was down roughly 15% for the year. Sentiment deteriorated quickly. Commentary shifted from cautious optimism to outright concern.

Investors questioned whether the rally that defined the prior period had finally run out of fuel.

A Year That Looked Broken — and Finished Strong

Then the market did what it so often does.

From those April lows, stocks surged with surprising force.

Over the remainder of the year, the S&P 500 climbed close to 40%, recovering losses and then some.

By year-end, the index finished up nearly 18% for 2025.

In other words, investors experienced a peak-to-trough drawdown of about 19% yet were rewarded with a double-digit gain by staying invested.

That combination feels contradictory, but it shouldn’t. This is one of the most common and misunderstood patterns in market history.

Why Markets Fall Faster Than Fundamentals

Most investors experience markets emotionally, not mathematically.

A 15% decline feels catastrophic when it is happening, even if it later proves temporary.

Losses trigger fear far more intensely than gains trigger satisfaction. As prices fall, the human instinct is to seek safety, even when the data does not justify permanent pessimism.

That instinct often leads to selling near moments of maximum discomfort.

A sudden collapse in long-term fundamentals rarely causes drawdowns like the one seen in early 2025.

More often, they reflect uncertainty.

Economic data softens. Policy expectations shift. Valuations reset.

None of these forces requires earnings to disappear, but they create enough doubt to push investors toward risk reduction at the same time.

When many market participants act defensively together, prices overshoot to the downside.

Once fear peaks, the process reverses.

Businesses keep operating. Profits continue. Economic outcomes prove less dire than expected.

Investors who moved to the sidelines realize they are underexposed.

Cash starts flowing back in. Momentum builds.

What felt like a broken market weeks earlier suddenly begins to accelerate higher.

That is precisely what played out in 2025.

The Real Cost of Long-Term Returns

Importantly, this pattern is not rare.

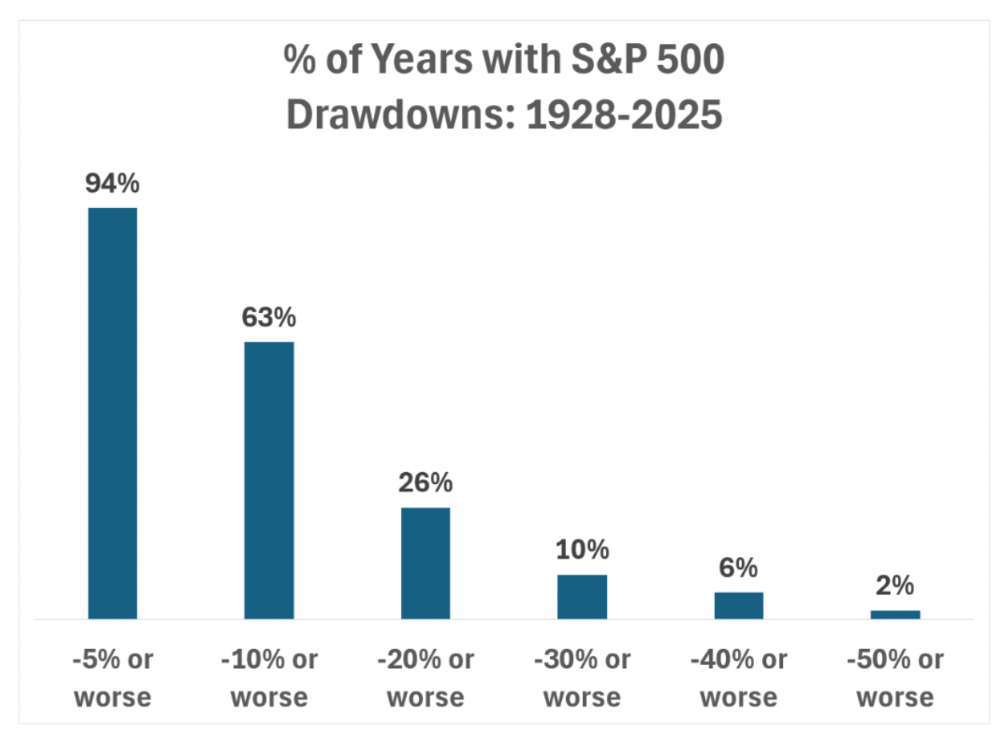

Here is a chart from the Ben Carlson piece we referenced…

Two-thirds of the time the stock market sees a double-digit drawdown. One quarter of the time that is more than -20%.

The good news is that only 10% of the time is it -10% or more.

The other good news, is that history shows that markets frequently endure double-digit drawdowns during the year and still finish with positive, and often strong, returns.

The challenge is not knowing this intellectually. The challenge is living through it emotionally.

There are exceptions.

Periods like 2008 or extended bear markets tied to systemic stress do occur. But they stand out precisely because they are uncommon.

The more typical experience is discomfort followed by recovery, not collapse.

The lesson from 2025 is not that volatility should be ignored. It should be expected.

Smooth markets tend to breed complacency. Volatile markets test conviction. Those tests are the mechanism through which long-term returns are earned.

At HX Research, we view years like 2025 as reminders rather than surprises.

The market does not reward certainty.

It rewards discipline.

Investors who remained patient through the April lows were not lucky. They were simply aligned with how markets have always functioned.

Volatility showed up, did its job, and moved on. The reward came later.

It will happen again.

Given this weeks news about an investigation into Federal Reserve Chairman Jerome Powell and political pressure on the Fed, we thought we would share one of our most controversial notes of all-time.

We still 100% support the thoughts laid out in this note from 2024. Enjoy…

HX Daily Redux

Jerome Powell is NOT an Idiot

Given that today is the second day of the September Federal Reserve meeting and marks the first Fed Funds rate cut(s) in several years, we thought it would be a good time to look up some quotes from Chairman Jerome Powell.

One of the first quotes we found was this one…

“There is no risk-free path for monetary policy.”

This quote got us thinking about what the Fed does for the economy.

We have always been bothered by the strong consensus opinion that the Federal Reserve doesn’t know what it is doing and is constantly wrong.

The first aspect of this opinion that bothers us is how and why the people who express it think they know better.

The most knowledgeable critics have the same background as the Fed Governors. They went to the same schools, share many life experiences, and have many commonalities.

Why would THEY have better insight than these people (the Governors) who have more data and do this full-time with vast teams working with them?

For the rest of us – why on Earth would WE think we know any better?

We don’t have the training, the information, the team, or the experience!

It reminds me of a football fan watching an NFL game and yelling at the coach for a particular call.

I am sure that the fans might be knowledgeable, but to think that they know better than this highly trained and experienced professional who has massive access to information and has studied the situation is ludicrous.

That is what any one of us criticizing the Fed Governors is like in my view…

That analogy also gets me to the quote we share from Powell above.

My belief is that the Fed knows what it is doing and is in the best position to make decisions that will steward our economy's growth and stability.

That does not mean they get every call right, just like a professional football game.

It also doesn’t mean they will WIN every game.

The goal is to get most of the calls right and post a winning season that eventually ends up winning the championship.

This is also a lot like TRADING or INVESTING. You would never expect a money manager to get every single call right.

What you want them to do is do the work, have a sound process, and then make the best decisions possible that ultimately result in your portfolio making money.

During that process, you are likely to lose positions. You may also have months or quarters where you lose money. You could have long streaks of not getting much right because some assumptions you have made are incorrect.

If you are a good trader or money manager, your process evolves, and you adjust to your mistakes.

This is EXACTLY what the Fed does, in my opinion.

They underestimated the magnitude and duration of inflation, so they raised rates. They may have had to do much more than they originally anticipated.

Eventually, though, we reached a point where inflation was under control (now), and growth stayed steady.

To me, the Fed has taken us to the playoffs for the last five years. We survived one of the most traumatic socio-economic events in human history, COVID. We did it without the economy collapsing and with overall social stability.

We have also quickly returned to steady and stable growth with rising incomes.

The Fed has done a tremendous job

in the three decades of my career.

Looking back from the early 1990s to today, we have seen huge progress as an economy, a society, and a stock market.

This isn’t BECAUSE of the Fed but rather because of American capitalism and the growth and stability inherent in our economic and social system. The citizens and companies are the players. They ultimately are responsible for the winning.

The Fed is the coach, though, and they – in unpopular opinion – have done a pretty darn good job of getting us to the championship year after year.

We think Jerome Powell and the rest of the Fed Governors are smart, and we are glad we have them working on our behalf.

Do you think the Federal Reserve has done a good job stewarding our economic growth and stability? Let us know your thoughts in the comments section below or at [email protected]

Market Wizard’s Wisdom

The “Money Game” Master

One of the great aspects of Wall Street is the ability to learn from the past.

While the stocks may change and the economy has evolved, the human behavior that underlies the movement in the stock market remains the same.

This means that not only can we learn lessons from what happened a few decades ago, but we can also look back even further.

Very early on in my career, I was interested in learning from Wall Street history, and this brought me to a series of books written by an author named “Adam Smith.”

Now you will recognize that name as the 18th century Scottish economist and philosopher but in this case, it was the pseudonym used by financial author and journalist George Goodman.

Goodman had an impressive background. After graduating magna cum laude from Harvard and as a Rhodes Scholar, he joined the US Army Special Forces serving in a precursor to the Green Berets.

He began his writing career in the 1960s and his first non-fiction book, The Money Game (1968), was a number one bestseller for over a year.

He authored a number of other books, and we encourage you to buy and read them. Here is a full list…

Goodman was a member of the Editorial Board of the New York Times, an editor of Esquire Magazine, a writer for Fortune and a founding member of New York magazine.

His writing was known for creating a style that could make the concepts of Wall Street more understandable and accessible to normal people. This is the same style we try to do today!

After an incredible career, Goodman passed away in 2014 at the age of 84.

Below are some of our favorite quotes of his about the financial markets and life. We hope you enjoy it!

“Prices have no memory and yesterday has nothing to do with tomorrow.”

This is an important philosophical point as an investor.

My former colleague Gabe Marshank use to share the old Wall Street saying, “The stock doesn’t know what you paid for it.”

We don’t agree with the interpretation of this saying that the past can’t help predict the future.

What we do agree with, though, is that your gains or losses in a stock should not influence your next decision.

“The first thing you have to know is yourself. A man who knows himself can step outside himself and watch his own reactions like an observer.”

One of the first pieces of advice we have for new investors is to figure out your goals and what kind of investor you want to be.

What are you trying to achieve?

Big returns are very different than long-term compounding.

The next step after that is then figure out what kind of investor you really ARE.

The fact is that not all types of investing fit all types of people.

Learning to match your goals to yourself is one of the key steps in maturing as an investor and your future success.

“If the profit numbers on income statements are treated with such reverence, it was obviously only a question of time before some smart fellows would start building companies not around the logical progression of a business, but around what would beef up the numbers.”

This is a pretty deep insight and describes a process that has happened over the last 75 years.

Company managements now understand and often will focus on those numbers over the actual financial health and success of their business.

Is this bad?

It often can be, but not necessarily.

We would make another point – novice investors and traders ALSO need to figure out what matters for an individual stock.

Don’t focus on what you THINK a stock should trade on. Focus on what it actually DOES trade on.

“It is much easier to say, “While the near term is uncertain, long-term holdings need not be disturbed,” than to say, “Dump this one.”

The phrase “I own it for the long-term” has lost as much money for investors as any phrase out there.

If the thesis on your holding changes, sell it. Move on.

“The end object of investment ought to be serenity.”

Your best investments will be the ones you think about the least.

Your worst investments will be the ones you think about the most.

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply