- HX Daily

- Posts

- HX Weekly: October 13 - October 17, 2025

HX Weekly: October 13 - October 17, 2025

The AI Melt-up, Meme Stocks, and Jeff Bezos

Hello reader, welcome to the latest issue of HX Weekly!

Each week we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

The AI Melt-Up: Boom, Bubble, or Something In Between?

Last week on CNBC, legendary investor Paul Tudor Jones sounded the alarm, predicting that U.S. stocks may be entering a “blow-off” phase.

In his appearance, Jones drew a parallel to the dot-com boom of the late 1990s and suggested that all the ingredients for a powerful, potentially explosive rally are falling into place.

He stopped short of predicting exactly how things will play out. But his message was clear: the market is shifting into a new and more volatile gear.

For investors, this raises a timeless question:

How do you navigate a market that looks like a bubble but refuses to pop, at least for now?

Making predictions in these moments is tricky.

It’s easy for commentators to hedge their bets by forecasting a sharp rally followed by an inevitable crash.

If stocks surge, they can claim victory.

If the market collapses, they’ll say they warned us.

But timing such turning points has always been more art than science, and often more luck than skill.

The Double-Edged Sword of the AI Spending Boom

This current AI boom isn’t happening in a vacuum.

Unlike past bubbles driven primarily by speculation, today's rally is underpinned by real economic activity.

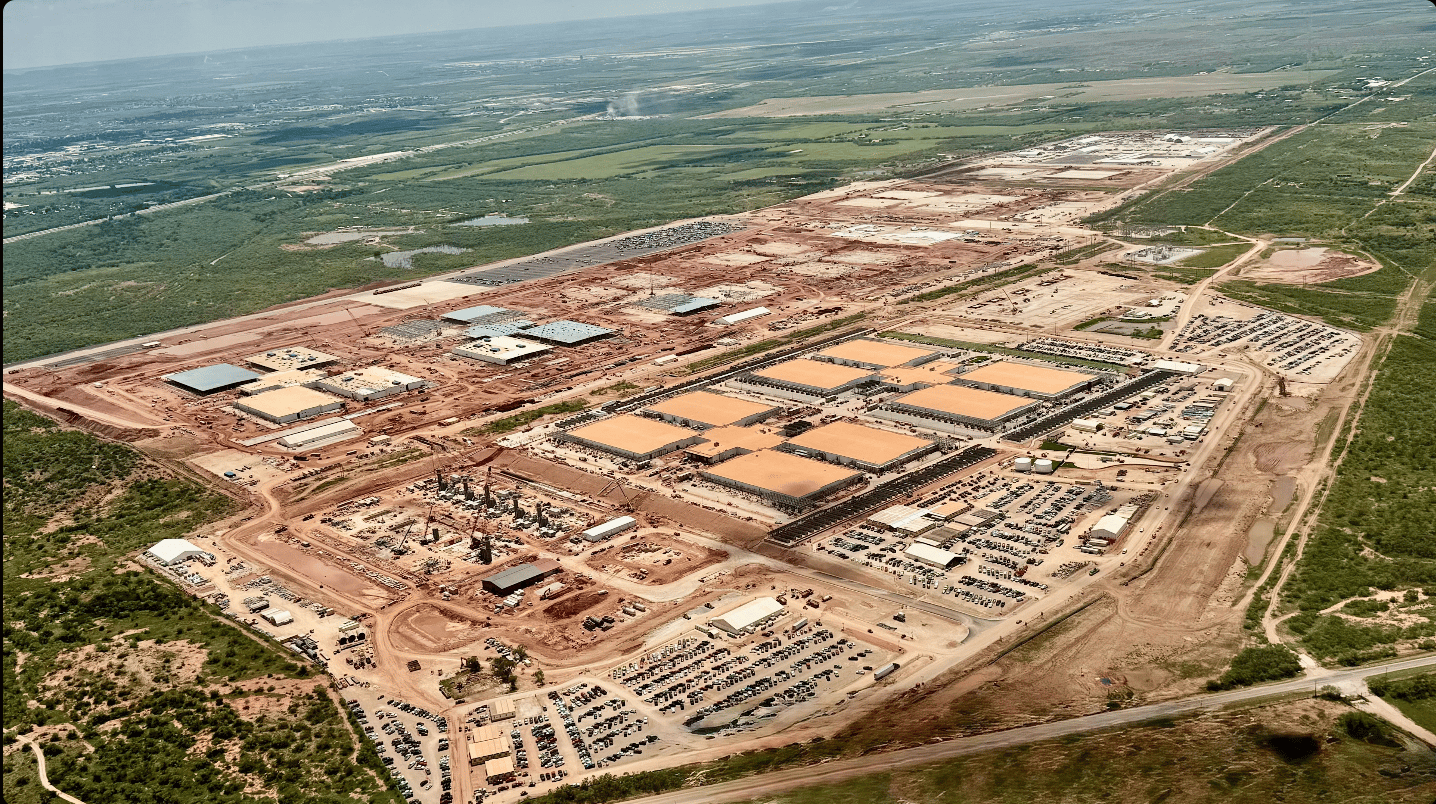

The world's largest technology firms are pouring hundreds of billions of dollars into building AI infrastructure: data centers, chips, software platforms, and energy capacity.

Stargate Data Center – Abilene, TX

That flood of capital is transforming the stock market and the broader U.S. economy.

The scale is extraordinary.

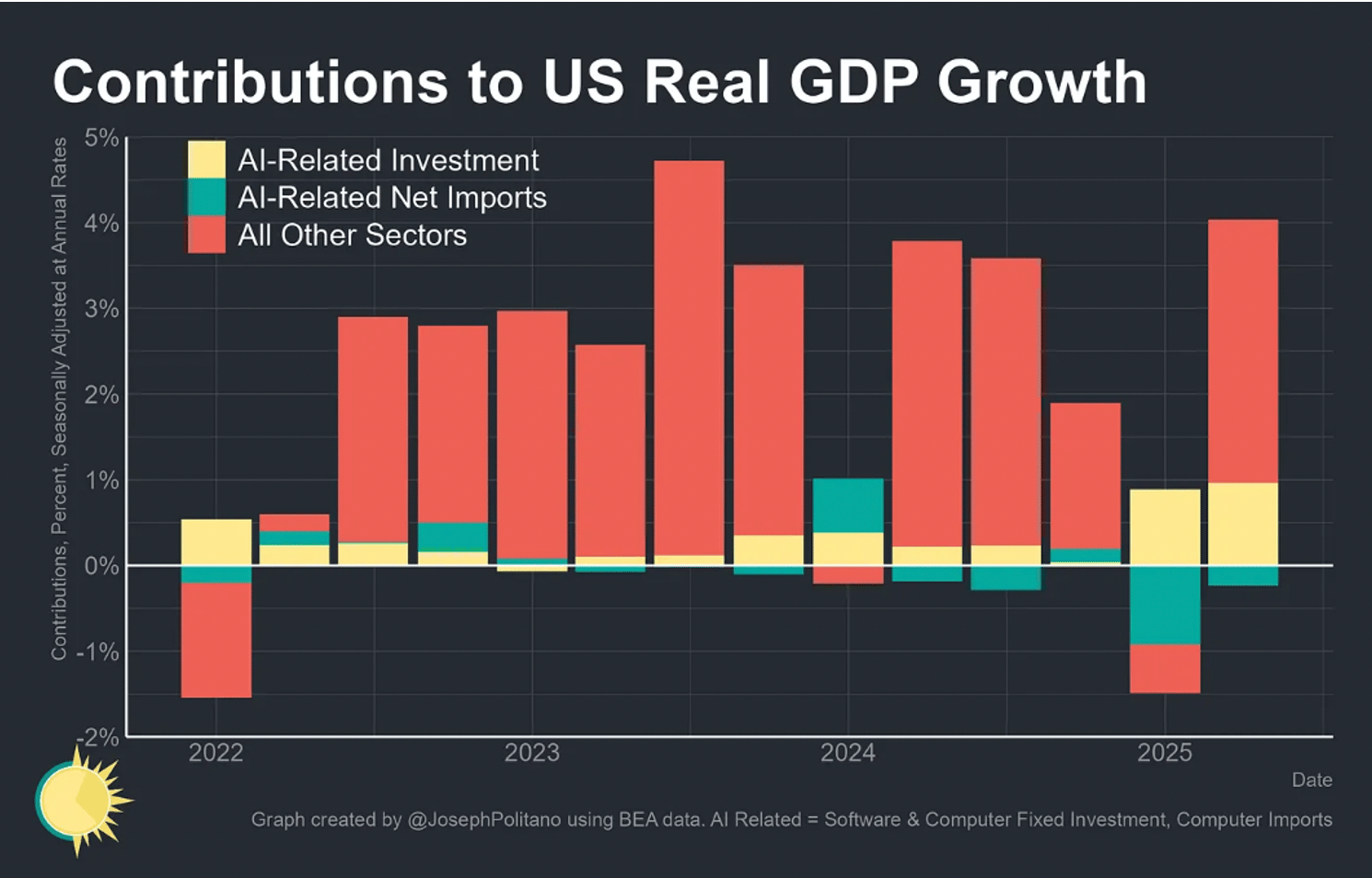

A recent chart by economist Joey Politano illustrates how significant AI-related investments have become as a share of total U.S. economic activity.

These aren’t marginal bets. They represent one of the most intense capital spending booms in modern history.

As a result, the AI surge is no longer just a tech story, it’s become an economic pillar supporting growth at a national level.

But what happens if that pillar wobbles?

Two broad scenarios emerge.

In the first scenario, the tech giants overshoot.

They spend far more than is needed, and the returns on those investments take years to materialize.

If that happens, the sector could face a brutal period of retrenchment, leading to a broader bear market.

In the second scenario, the investments pay off quickly.

AI makes companies dramatically more efficient and enables them to reduce costs. Cost cuts, which could include millions of white-collar jobs.

Ironically, the transition to an AI-driven economy that leaves many workers behind could be painful, too,

Either path carries risks.

The first could trigger an investment-driven recession. Meanwhile, the second path could spark social and employment shocks as businesses adapt to a leaner, AI-enhanced operating model.

And of course, there’s a wide range of middle-ground outcomes as well. But the key point is that AI is now so deeply intertwined with economic growth that a slowdown in AI spending could have ripple effects far beyond Silicon Valley.

Markets on Edge: Can Anything Fill the Gap?

For much of the past decade and a half, the U.S. economy has shown remarkable resilience.

Whenever one growth engine sputtered, another emerged to keep things moving.

When the pandemic hit, government stimulus and consumer spending took the lead.

When inflation surged and consumer demand cooled, AI spending increased to support growth.

But if this AI boom slows sharply, what could take its place?

Housing might be one candidate. If mortgage rates fall enough, the real estate market could stage a resurgence, providing a new source of momentum.

But that’s far from guaranteed.

For now, both the stock market and the broader economy appear heavily reliant on the continued strength of AI investment.

Why Calling the Top Is So Hard

Of course, many investors wonder whether we're nearing the end of this remarkable cycle.

Are we in the eighth or ninth inning of the game?

History offers little comfort.

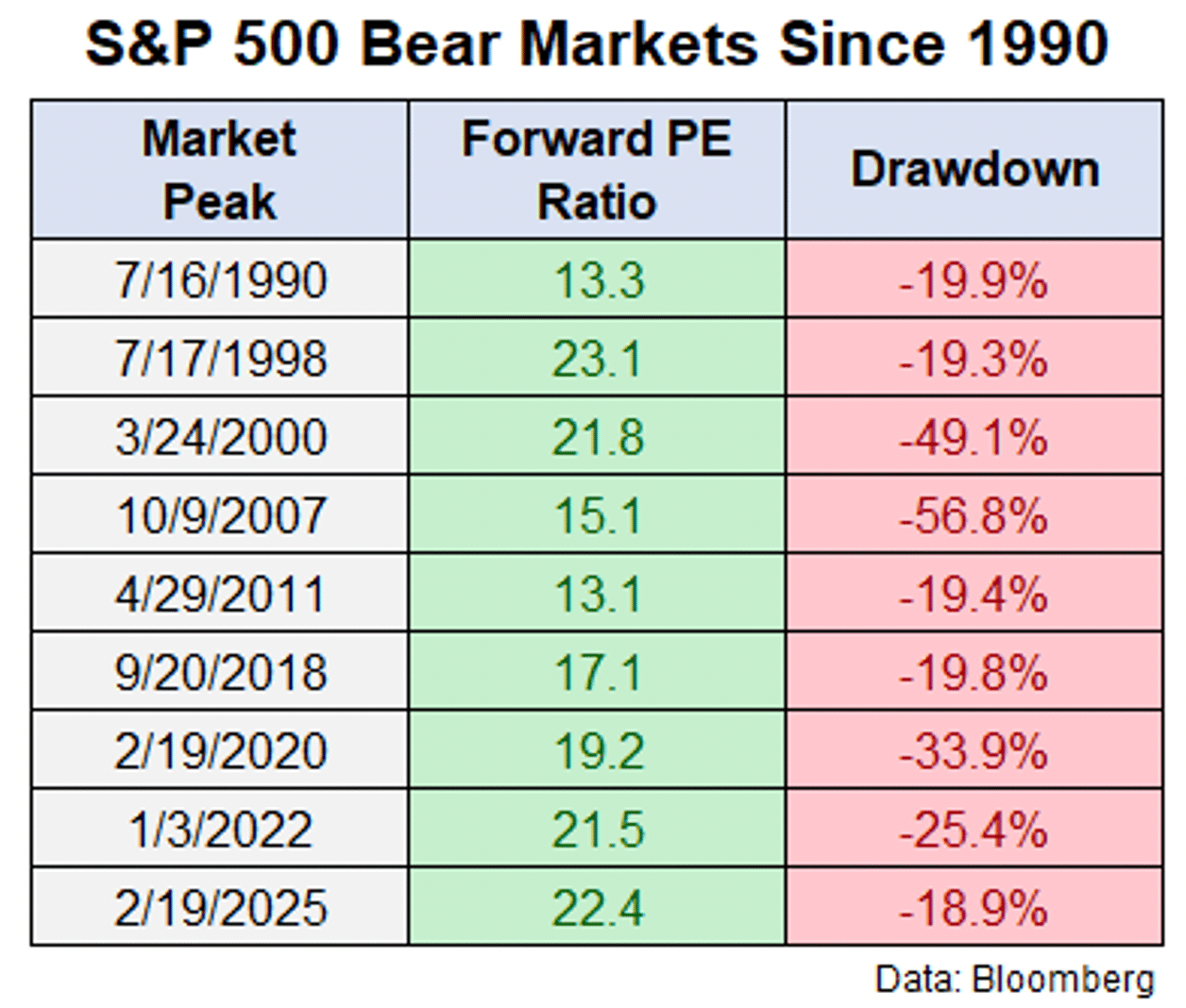

One chart tracking the forward price-to-earnings ratio of the S&P 500 since 1990 shows that markets have peaked at widely varying valuation levels before every major downturn.

Sometimes valuations soar well above the historical average of roughly 16.5 times earnings before a correction hits.

At other times, markets have rolled over from below-average levels. There’s no single line in the sand that signals the top.

Historically, investors who tried to call the top too early often missed out on substantial gains before the eventual collapse.

It’s a reminder that markets during innovation booms are driven less by numbers and more by narratives, emotions, and fear of missing out (FOMO).

Prepare, Don’t Predict

So, what should investors do?

The uncomfortable truth is that no one can consistently and accurately predict when a market cycle will end.

Anyone who gets it right once is more likely lucky than prophetic and will most likely never replicate that success.

Every boom eventually runs its course, but the timing is unknowable.

In such moments, wise investors should prepare for a broad range of outcomes rather than placing all their chips on a single prediction.

Rather than obsessing over the exact timing of the top, investors may be better served by diversifying, maintaining discipline, and staying focused on fundamental trends.

Whether this AI boom ends with a bang or a smooth landing, the shift it represents is real.

Its impact on both markets and the economy will reverberate for years to come.

HX Daily Redux

Market Mediocrity – The Trump Bull Market? Respect the Liquidity

Sometimes at HX Research, we like to look back and see what we were thinking and writing about a year ago.

Well, around this time last year, we were writing about how, despite the market’s outperformance, we were seeing relatively little “meme stock” activity.

Flash forward to October 2025, and we’re observing dozens of companies with no actual products or revenues trading at multibillion-dollar valuations.

In fact, there are so many that it's beginning to remind us of 2021.

Read on to see how we predicted today’s current “meme stock” activity precisely one year ago.

Enjoy!

With the launch of HX Research, we have had the opportunity to meet many great financial authors.

One of our favorites is J.C. Parets of All-Star Charts.

In addition to being an all-around great guy and huge baseball fan, J.C. has some of the best insights out there into the markets. He approaches the markets from a technical perspective and is focused on WHAT WORKS.

He published a note last week about the recent price action in Donald Trump's social media company, Trump Media & Technology Group Corp. (NASDAQ: DJT).

The note highlights his approach's best attributes: its focus on what is really happening in the markets and tuning out the "noise" to make money.

We also encourage you to follow JC Parets on X/Twitter and sign up for his free newsletter.

The gist of the note is that DJT has had a massive run in the last few weeks—it has DOUBLED!

We don't know how familiar you are with the company, but it is controversial, to say the least.

Half the people are obviously angered by the Trump element, but we think even more investors are angered by the valuation.

The company has an almost $5 billion market capitalization but made just $836,000 in revenue in the most recent quarter. This is down from -30 % in the same quarter last year.

Putting this in perspective, this means that they are doing less than $4 million of annualized revenue, and it is going down—not up. An objective fundamental analyst would look at what the company is doing fundamentally and have little confidence that it is going to grow anytime soon.

This means that the company trades at an incredible 1,250 times REVENUE!

This is infuriating for traditional fundamental investors – especially those in the "value" camp. It shouldn’t even exist.

Trump is controversial, but the valuation violates the fundamental value investor worldview.

Yet—it does exist. The stock also just gave nimble investors a +100% return in just a few weeks.

This brings up one of our most important insights at HX Research – STOCKS ARE NOT COMPANIES.

We have said this many times, and it is probably the most difficult concept for most traders and investors to understand.

While – in theory – when you own a share of stock, you own a piece of the company, the reality is that this doesn't mean anything. It is not like you ever see the day-to-day cash flow of the business like you would if you owned a private business like a restaurant.

DJT is another example of this rule. Nothing stops the company from trading at 1,250 times revenue or even 12,500 times revenue.

In the short term, the enthusiasm of buyers and sellers will define the price of the stock.

Traders who bought the stock at $12 three weeks ago and sold it today for $24 are receiving real money, regardless of the company's valuation and what it is "supposed" to be trading at, according to traditionalists.

We are not saying you should trade a stock like DJT. However, for nimble traders who truly understand the markets, we think these kinds of stocks can produce a ton of profits. In our view, though, they are only for the most sophisticated traders.

J.C. makes another great point about DJT and the stock market that we agree with—this type of price action is BULLISH.

Some of you might point to it and say it is part of a "bubble" and that, eventually, it ends badly. We agree that it IS a “bubble” for DJT stock, and we will be amazed if buyers of the stock at these levels make sustainable profits.

Think back, though, to the stock market environment of 2021.

Only a few areas of the stock market today (like DJT) are experiencing these crazy price rallies.

Back in 2021, it felt like there were hundreds!

We think what we are seeing is the beginning of a similar eruption. Think of it like a volcano—DJT and some of the other big rallies in stock are the first spouts of lava bursting through the ground.

Eventually, we think there could (again) be many more of these, and THAT will be a sign that the volcano is about to explode and ruin everything.

For now, figure out how to identify these explosive opportunities and take advantage of them!

Market Wizard’s Wisdom

Entrepreneurial Genius: The Wisdom of Jeff Bezos

For this week's "Market Wizard's Wisdom," we're revisiting a note that we published in January about Amazon founder Jeff Bezos.

While this may seem odd for an investing newsletter, it's important to remember that he's one of the most successful entrepreneurs in history.

We think you'll find his quotes quite insightful and complementary to this week's lead piece.

Enjoy!

While we are focused on the stock market and trading securities, not all of the profiles we do are on traders or investors.

We find great wisdom that can be applied to the market from many different areas. Sometimes, it is philosophers; other times, it is writers or even (gasp) politicians.

Today's issue highlights one of the greatest entrepreneurs of recent history – Jeff Bezos.

By Daniel Oberhaus - Own work, CC BY 4.0, https://commons.wikimedia.org/w/index.php?curid=154476405

Bezos comes from a complex background that many don’t know.

His original name was Jeffrey Preston Jorgensen, and he was born on January 12, 1964, in Albuquerque, New Mexico. His mother was 17, and his father was 19 when he was born.

His father was actually a unicyclist (!) and struggled with alcohol and his finances. His mother left him shortly after Jeff was born and married a Cuban immigrant named Miguel “Mike” Bezos. The family then moved to Houston, TX before eventually settling in Miami.

After graduating summa cum laude with a degree in Engineering from Princeton, Bezos began his career at a telecommunications start-up before going to work at Bankers Trust and then joining early hedge fund pioneer D.E. Shaw & Co.

After reading about the explosive growth in web usage, Bezos left D.E. Shaw at 30 and began Amazon (originally named "Cadabra") out of his garage shortly thereafter.

We won't go through all the details of Amazon's incredible success but will share some of his great quotes.

While these are not focused on the markets, his insights easily translate to trading and investing…

“If you don't understand the details of your business, you are going to fail.”

As traders and entrepreneurs, we can't emphasize how important this concept is for success.

Perhaps the biggest failure by traders is not understanding exactly how and why they are both making and losing money.

At my hedge funds, we continually improved by constantly analyzing our returns. We then looked to identify common factors in our biggest winners and losers.

From there, we looked to do more of what was working and eliminate what was losing us money.

This process of constant analysis and assessment is a MUST for your process.

“The human brain is an incredible pattern-matching machine.”

If you use technical analysis like we do, this is something you monetize every single day.

Bezos has tremendous respect for the ability of the human brain to quickly take in information and figure out patterns and solutions. It is one of our most significant evolutionary advantages.

Understanding that repeatable patterns can generate high-probability situations is the basis for successful trading.

“Our motto at Blue Origin is 'Gradatim Ferociter': 'Step by Step, Ferociously.'”

I had never seen this quote, but I absolutely love it!

It emphasizes both process and conviction.

Regarding our strategies, we always say that we operate with great belief in our methods but quickly change our minds based on new information.

The concept of high conviction yet willingness to quickly change your course is difficult for most folks to understand.

It is also a trait shared by the greatest traders of all time.

“It is very difficult to get people to focus on the most important things when you're in boom times.”

We see this every day in the BULL market.

Smart traders become distracted by the next “shiny” fad that is working and drop their disciplines.

This might pay off for some time, but inevitably, they lean too far into it. Then, when these fads collapse, these investors are devastated.

We think it is MORE important to be disciplined in a BULL market than a BEAR market. It is also much more challenging to accomplish.

“What's dangerous is not to evolve.”

In the markets, it is an absolute must that you continue to evolve your process to survive and succeed.

Remember that markets themselves evolve. Don't try to trade the market you want; trade the market you have.

Embracing evolution in your process will allow you to create a sustainable one that can weather any market environment.

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply