- HX Daily

- Posts

- HX Weekly: October 6 - October 10, 2025

HX Weekly: October 6 - October 10, 2025

Shutdowns, Stock Surges, and More

Hello reader, welcome to the latest issue of HX Weekly!

Each Friday, we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

Shutdowns and Stock Surges: Why Markets Often Rally When Washington Fails

Today, October 10, marks the 10th day of the latest government shutdown.

As political tensions rise in Washington and another federal government shutdown unfolds, many investors are once again asking a familiar question:

What happens to the stock market during these episodes of dysfunction?

The answer might surprise you.

Despite the noise and uncertainty, markets tend to weather these storms, and sometimes even thrive once the dust settles.

The current shutdown, now nearing the end of its first full trading week, hasn’t caused much panic on Wall Street.

In fact, between October 1 and October 6, the S&P 500 climbed 0.80% and even reached new highs on a few trading days.

That’s hardly the picture of a market in distress.

So, what’s really going on?

History Shows Shutdowns Don’t Derail Markets

It turns out that government shutdowns, while disruptive in Washington and certain parts of the economy, haven't historically caused long-term harm to stocks.

In many cases, markets have bounced back strongly once the shutdowns ended, or even during the events themselves.

While every situation is different, the big picture shows a consistent theme: patience often pays off.

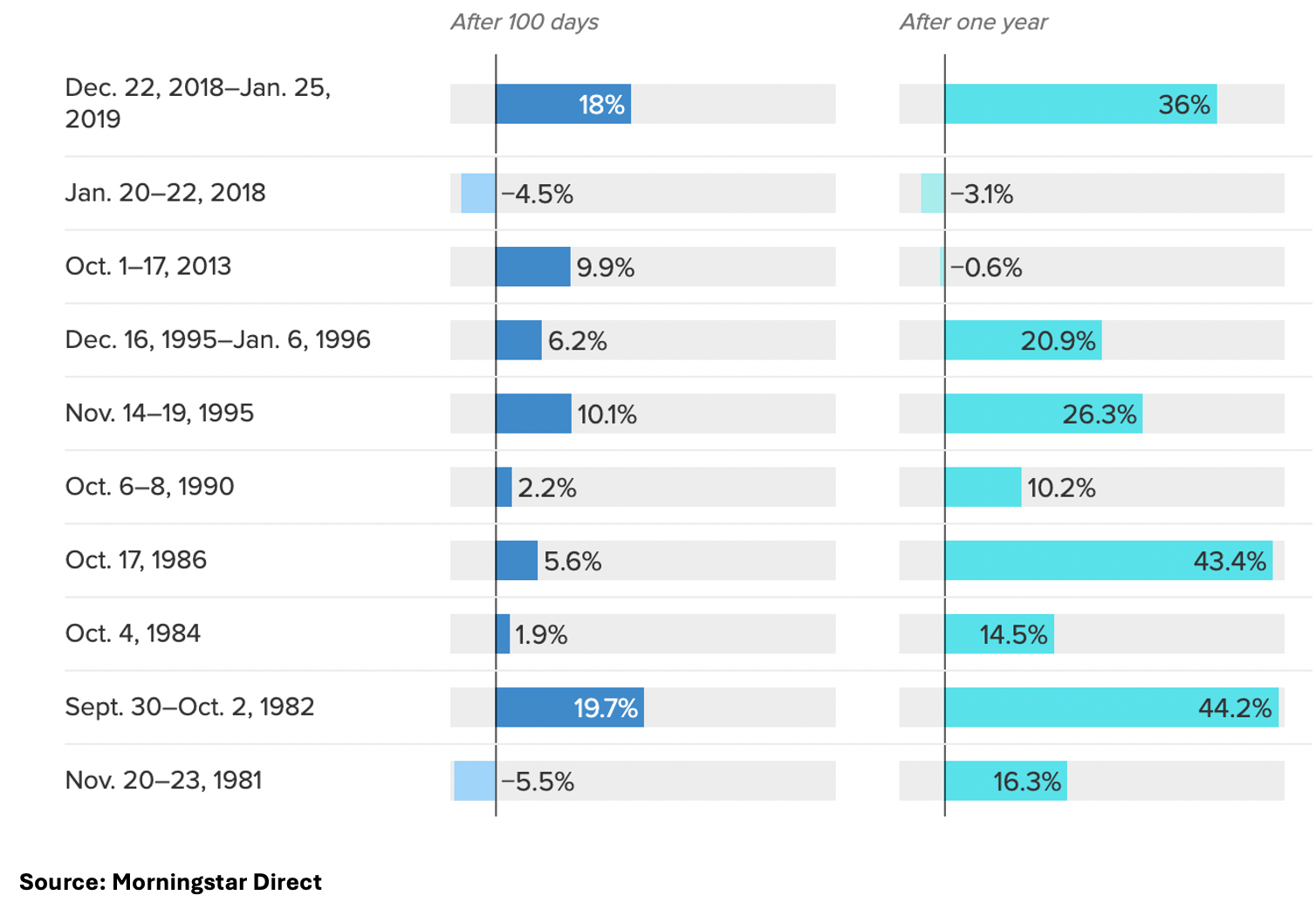

S&P 500 performance following U.S. government shutdowns since 1980

Take the 2018–2019 shutdown, which stretched into early January and became the longest in U.S. history.

Within one year of its conclusion, the S&P 500 surged 36%, rewarding those who stayed invested.

Going further back, the 1982 shutdown saw the index rise nearly 20% within 100 days.

These aren't isolated examples, either. Many past shutdowns were followed by periods of solid market gains.

Still, the trend isn’t guaranteed. Not every shutdown leads to a rally.

After the brief January 2018 shutdown, the S&P dropped 4.5% over the next 100 days and was still down slightly a year later.

But those exceptions haven’t been enough to change the broader narrative.

Shutdowns may shake the headlines, but haven't consistently shaken investor returns.

The Market Is Always Looking Ahead

So why do markets hold up so well during these moments of political chaos?

One key reason is that markets are always looking ahead. Investors don't necessarily react to the day's drama, but to what they believe the future holds.

When it comes to shutdowns, many view them as temporary noise, loud and messy, but unlikely to change the longer-term path of the economy or corporate profits.

That’s the view of many financial professionals.

As Andrew Hiesinger, CEO of the market intelligence firm Quant Data, explains it: “Markets tend to focus on where things are going, not where they are now.”

In other words, if the underlying economy remains strong and interest rates are expected to fall in the coming months, the market may rise even as Congress squabbles over the budget.

The current market stability reflects this forward-looking mindset. Investors are betting that inflation will keep easing and that the Federal Reserve may eventually cut interest rates to support the economy.

Those forces are far more potent than a few days or weeks of federal gridlock.

The Case for Staying the Course

Cathy Curtis, CEO of Curtis Financial Planning in Oakland, California, believes investors should take a deep breath during times like these.

Her advice: don’t overreact. “The best response to a shutdown is usually no reaction at all,” she says. “Those who stay invested during periods of uncertainty are often the ones who benefit in the long run.”

Of course, shutdowns can have real consequences for certain parts of the economy.

Federal workers can miss paychecks, government contractors may face delays, and agencies may suspend key economic reports.

If a shutdown drags on too long, it can create ripple effects that hurt growth or cloud visibility for policymakers and businesses alike.

But so far, that hasn’t spooked markets, at least not this time.

Diversification Is Your Defense

Investors can also take this moment to reflect on the value of diversification. When headlines get noisy, owning a broad mix of stocks, like through an index fund or ETF, often offers better protection than betting on individual companies.

That's because diversified portfolios are designed to ride out volatility and stay aligned with the market's overall direction, rather than get whipsawed by daily news.

Historical data helps tell this story more clearly.

A look at S&P 500 returns after every shutdown since 1980 shows that the market moved higher within 100 days in most cases and often posted even stronger gains by the one-year mark.

While declines followed a few shutdowns, the overall pattern suggests that reacting emotionally to political events isn't a winning strategy.

Shutdowns Make Noise. Long-Term Investors Win.

That message matters now more than ever. With another shutdown underway and more fiscal battles likely ahead, investors must stay focused on the long-term.

Markets don’t like uncertainty, but they’ve learned to tune out the routine drama of Washington politics. As long as the core drivers of the economy remain in place, stocks may continue to push higher—regardless of what happens on Capitol Hill.

In the end, a shutdown might delay a paycheck or a data release, but it doesn’t have to derail your financial goals.

History shows that staying the course, not fleeing for safety, is usually the smarter move when political turmoil flares up.

Patience, discipline, and perspective remain an investor’s best defense against the noise.

HX Daily Redux

Market Mediocrity – The Big Finish

Sometimes at HX Research, we like to look back and see what we were thinking and writing about a year ago.

Well, around this time last year, we were writing about the market’s historical performance during Q4.

Given that we’re barely two weeks into Q4 2025, this piece deserves a fresh read.

Enjoy!

Our regular readers know that we are big proponents of the idea that the time of year can affect stock market returns. This is referred to as “seasonality.”

In financial theory, where we are on the calendar shouldn't matter. However, it does in the real world of trading.

There are many reasons why it has an impact.

Companies report financial results every three months or “quarter.” They are also measured on a calendar year basis, which means that their results and guidance can change throughout the year.

The 3rd quarter is often volatile because companies no longer have enough of the year to compensate for disappointing results. These results are usually reported in October but previewed in September if there is a problem.

This is one reason why September has historically been a tough month for the market. Here is a table showing the average monthly returns for the S&P 500…

This year, September went against this trend, and the S&P 500 was +2.1% for the month.

The seasonality trends are about probability, not certainty. This year, we saw some volatility to start the month, but there were not many negative pre-announcements or bad economic news.

This now sets us up for the end of the year, and seasonality has been strongest here by far.

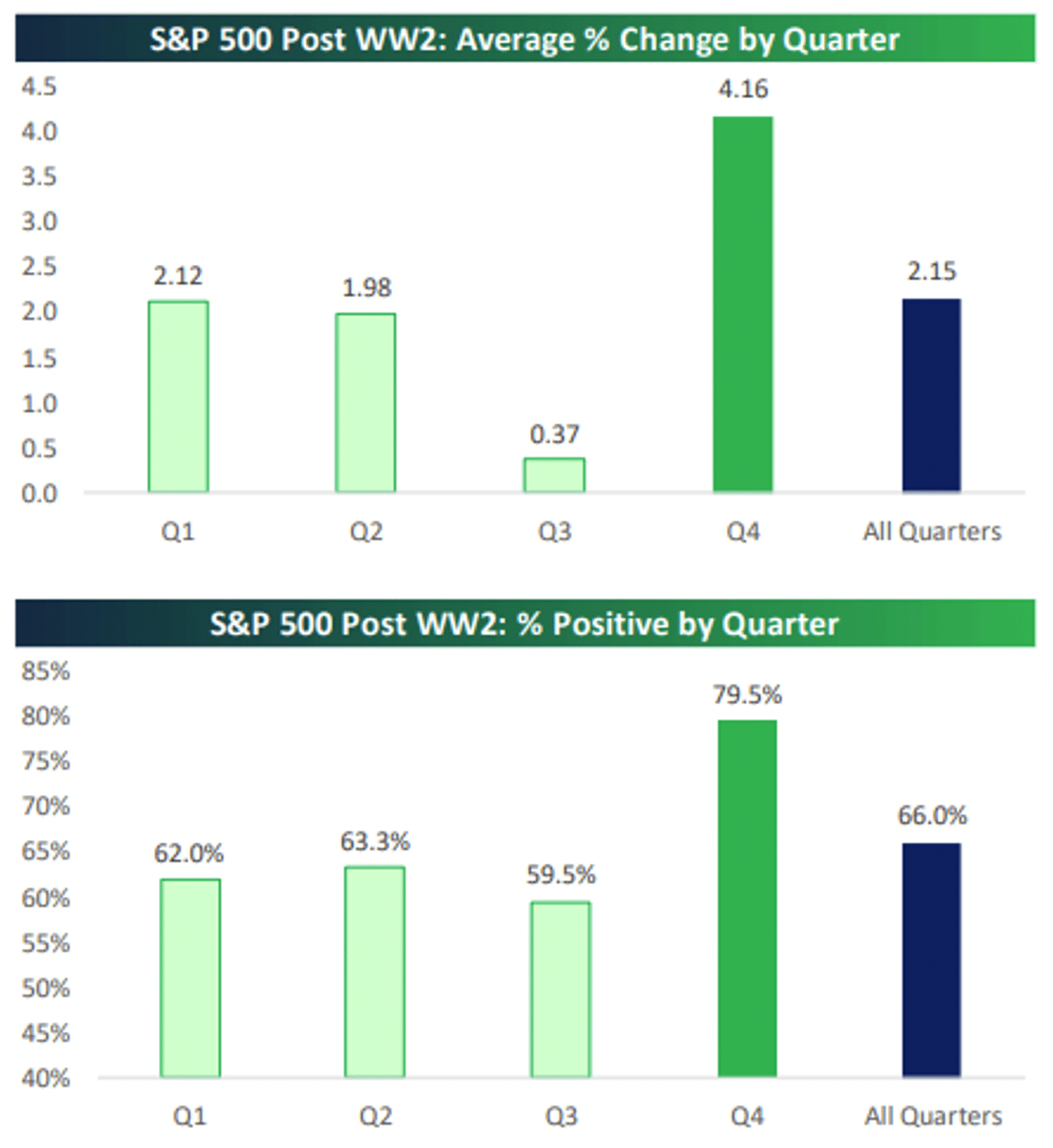

Here are a couple of tables from one of our favorite research shops – Bespoke Investment Group – that show the average return and how often the stock market is up in the fourth quarter…

You can see that since World War II, the S&P 500 has been up almost double the average for all quarters and positive almost 80% of the time.

Those are both solid returns and a high probability of a positive outcome.

We discussed how the earnings reporting season can drive weakness in September and October. Why does the year-end lead to market strength?

It is for similar reasons having to do with the calendar.

Most professional money managers are compensated on a calendar year basis. At the end of the year, they are highly motivated to see the market rise.

They know they will get paid based on their performance as of December 31, so they will do everything they can to raise the market.

Also, if the stock market is strong going into Q4, then managers have a "cushion" with which to support it.

If a manager is flat or down going into Q4, then they are not likely to be aggressive and buy stocks when they are down.

However, if that manager is up solid double digits, then they are likely to buy every dip.

The stock market in 2024 is up historically. It is quite rare for it to hit a new all-time closing high on the last day of Q3, but it did so this year.

Here is another great chart from Bespoke showing when this has happened in the past and what happens in both October and Q4…

This is rare, having only happened four times since 1945. All four times, the stock market was higher in both October and the fourth quarter. The Q4 returns have also been solid.

We think we are likely to see a similar outcome in 2024, but we also think it makes sense to be cautious in the very near term.

Here is a chart from Ryan Detrick of Carson Investment Research showing what happened in October when the stock market was up more than 20% going into Q4…

The S&P 500 has been down most of the time, although there was only one bad month in 1987.

The strength of the stock market and economic data has pushed sentiment towards the high end of the spectrum.

Too many people on one side of the boat leave it vulnerable to volatility if it hits even a small stone in the river. That is where we think we are right now and would remain nimble in our trading allocations. Take profits when you have them.

We are cautious in the near term (weeks) and BULLISH on the stock market in the intermediate term (Q4).

Over the next year?

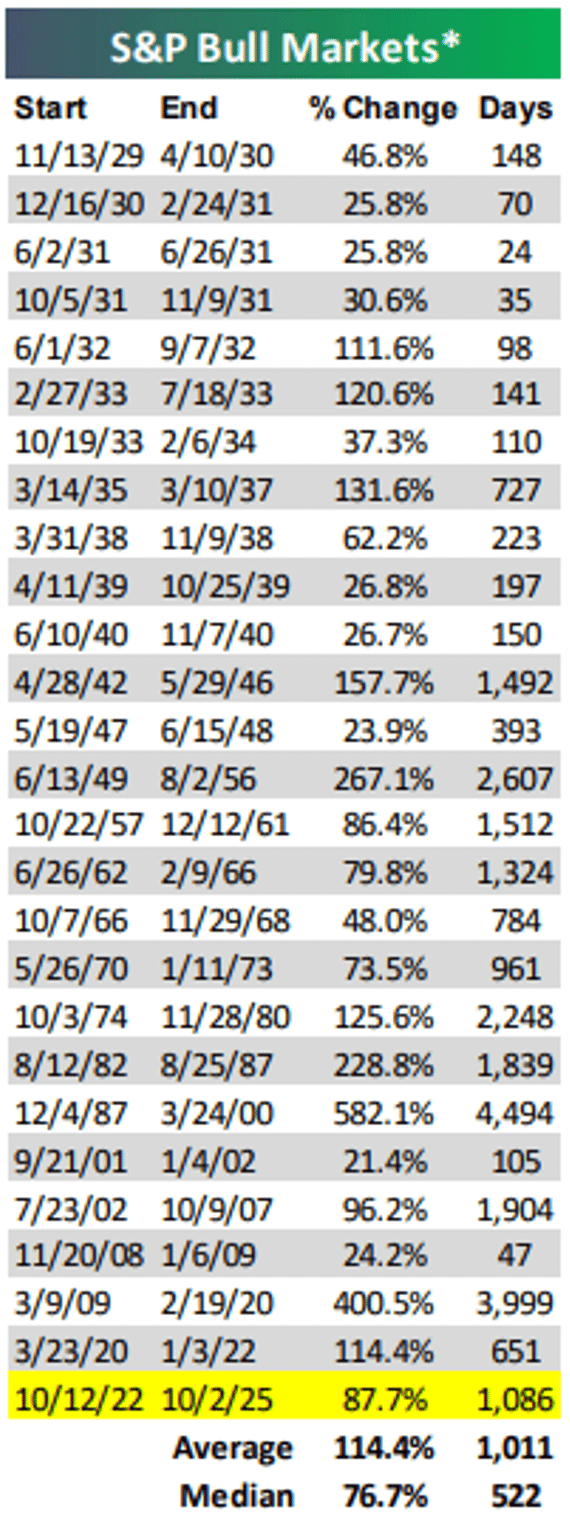

One last great table from Bespoke shows the BULL market's duration and magnitude since World War II…

*Updated from original post

The average duration has been over 1000 days, and the S&P 500 has more than doubled. We are about two-thirds of the way there on both measures.

We think this BULL has legs and will continue to run into 2025. Stick with it for the ride!

What is your outlook for the S&P 500 over the short, intermediate, and long term? Let us know your thoughts in the comments section online or at [email protected]

Market Wizard’s Wisdom

Friedrich Hayek - The Individual is Everything

For this week's "Market Wizard's Wisdom," we're revisiting a note that we published last October about Friedrich Hayek, the renowned Austrian economist.

Enjoy!

We took a two-week trip through five Eastern European countries at the start of this month.

We began our trip in Budapest, Hungary, and spent much of that week sharing the investment insights of legendary investor George Soros. Regardless of the controversy over his political activism, he still has some incredible wisdom for investors.

We finished our trip in Vienna, Austria, which got us thinking about a hugely influential group of economic thinkers that many readers may not know. They represent a group of economic philosophies that are referred to as the Austrian school of economics.

Look them up on Wikipedia, and you will read the following…

The Austrian school is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result primarily from the motivations and actions of individuals along with their self-interest. Austrian-school theorists hold that economic theory should be exclusively derived from the basic principles of human action.

Wow – that is a mouthful! What does it mean?

This group of economists believes that everything we see in society and economics is driven by each of us as an individual trying to get the best result for ourselves and our families. We added the "our families" part here because we think that most of us think not just of ourselves but also of our immediate group.

What we do NOT think when making most decisions about is the larger group of society. We are biologically programmed to get good results for ourselves, our family, and our “tribe.”

Regardless of the advancements in philosophy, economics, and technology, we will ALWAYS be humans driven by this biological programming.

We often emphasize this when discussing TRADING and INVESTING. Our evolution creates biases that we must overcome to be successful.

This approach contrasts with traditional views of economics, which are driven more by model-building and statistical methods. Economic traditionalists often dismiss it.

We think this is a mistake as it has far more applicable insights than any of those academics. Understanding our individual biases is valuable in trading.

This is why it is referred to as a “heterodox” school of economic thought.

(Editor’s Note – Do you know what the “HX” in “HX Research” stands for? Do the math…)

The Austrian school of economics focuses on these biases as the basis for our actions in society and the economy. Understanding them can help us better appreciate how society and the economy can develop and evolve.

We encourage you to learn more about this unique branch of economic study.

Today, we are going to share several quotes from the most famous Austrian school economist, Fredrich Hayek. He won a Nobel Prize in Economics in 1974 with his partner Gunner Myrdal, and he stands out for his insights. Enjoy…

“ ’Emergencies’ ” have always been the pretext on which the safeguards of individual liberty have been eroded.”

Hayek lived from 1899 to 1992 and witnessed some of the most horrific events in human history during World Wars I and II. He saw firsthand how authorities used a time of concern to take away individuals' rights, often with terrible results.

COVID?

“I do not think it is an exaggeration to say history is largely a history of inflation, usually inflations engineered by governments for the gain of governments.”

Another Hayek quote that predicts the future.

He rightly points out that the history of governments is one where they consistently devalue their currencies to protect the survival of the government.

While government most often begins with the best interest of the people in mind, it always ends up being focused on its own best interest.

“Our faith in freedom does not rest on the foreseeable results in particular circumstances but on the belief that it will, on balance, release more forces for the good than for the bad.”

This is a key concept in both libertarianism and capitalism.

The idea is that, if put in the proper system of rules, choices driven by individual (and family) self-interest will ultimately drive the best outcome for everyone. It is not a perfect system by far, but it is the best.

“Liberty not only means that the individual has both the opportunity and the burden of choice; it also means that he must bear the consequences of his actions and will receive praise or blame for them. Liberty and responsibility are inseparable.”

This statement is a key “proviso” to the Austrian school’s emphasis on actions driven by individual self-interest.

There has to be ACCOUNTABILITY to ensure that society and the economy can properly evolve and function.

Are you familiar with the Austrian school of economics and Hayek's work? Let us know your thoughts in the comments section online or at [email protected]

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply