- HX Daily

- Posts

- HX Weekly: September 1 - September 5, 2025

HX Weekly: September 1 - September 5, 2025

Pop Goes the Rally?

Hello reader, welcome to the latest issue of HX Weekly!

Each Friday, we bring you a new edition of HX Weekly that includes three distinct sections.

In the first section, Thoughts on the Market, we'll offer insights into current economic and market news.

In the second section, HX Daily Redux, we'll revisit investing concepts, tactics, and more from past issues of HX Daily.

And in the third section, Market Wizard’s Wisdom, we’ll share thoughts, quotes, and theories from the greatest investing minds of all time.

Now, let's dive in!

Thoughts on the Markets

History Says This Week Could Hurt

Hey everyone,

Here at HX Research, we've been closely monitoring the markets lately. And right now, things are looking shaky.

Over the next few days, we could see a decent-sized pullback in the stock market.

You'll want to pay extra attention if you hold popular stocks like Robinhood or Palantir. Those names have had a big run but may be the first to feel the heat if the market drops.

So, what’s got us worried?

It’s not politics or earnings reports this time. It’s the technical setup, the way the market’s moving on the charts.

When stocks rise too fast and hit specific signals, that's often when corrections happen. And right now, those signals are flashing red.

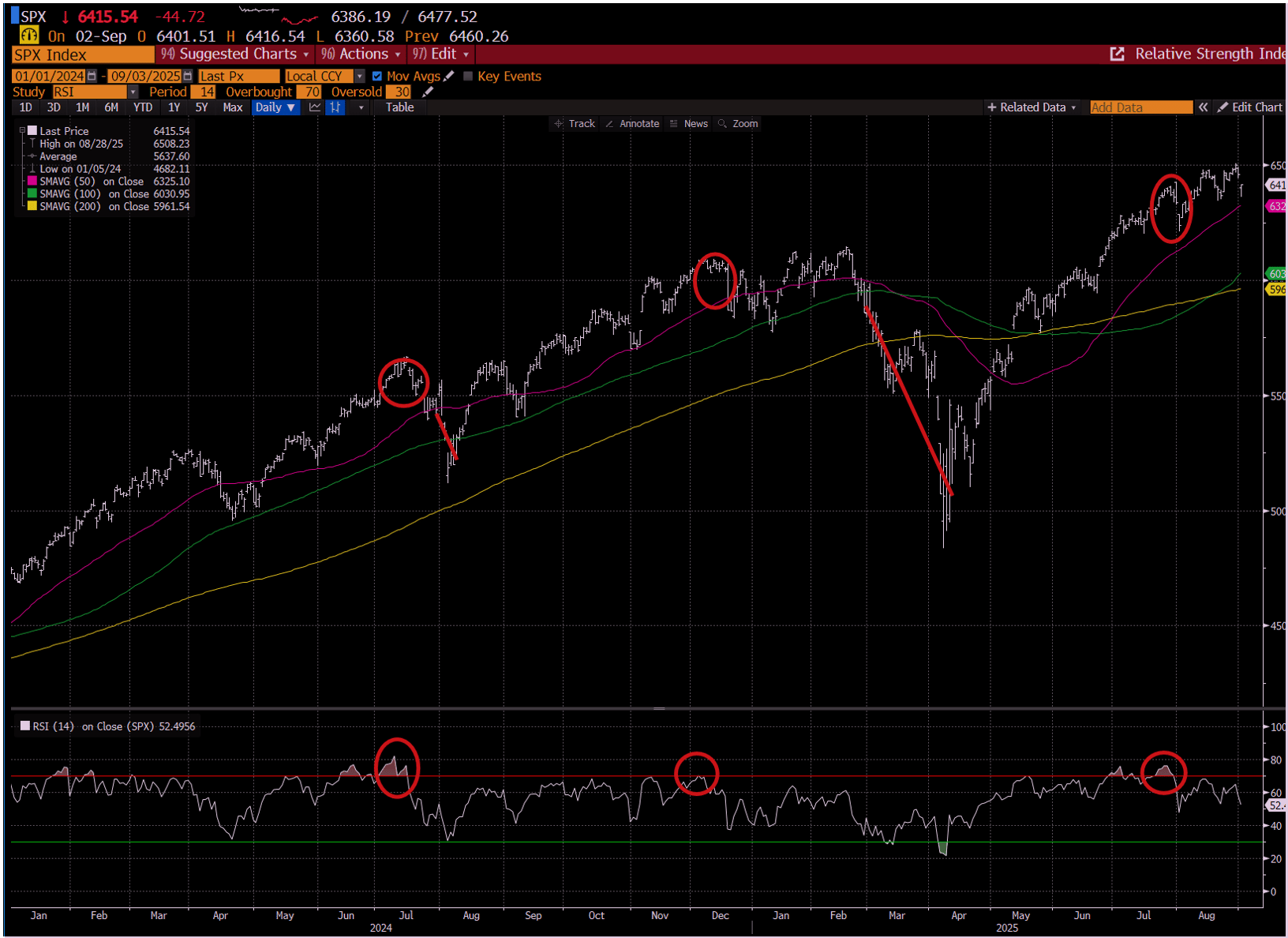

Let’s talk about the S&P 500. It’s one of the main ways we track the overall market.

Recently, it’s shot up far above its average trend line. And our favorite indicator, RSI, short for Relative Strength Index, has also climbed to levels that usually mean a pullback is coming.

That happened in July 2024, and the market dropped nearly nine percent in one month. It happened again in November, and stocks lost more than twenty percent. As of now, we're back in that same danger zone.

Take a look at this chart to see what we mean.

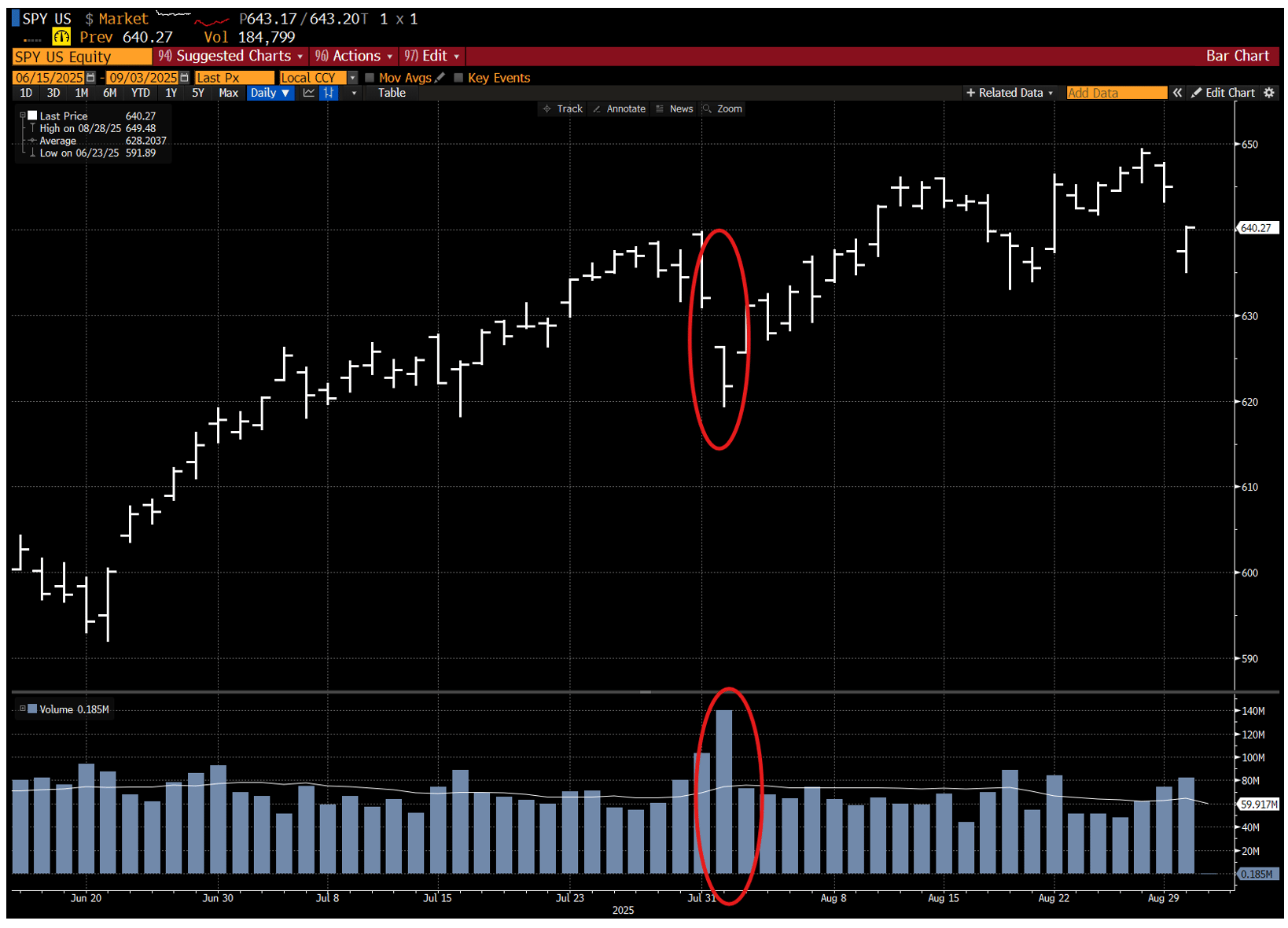

On top of that, something strange happened on August 1.

There was a sudden drop in stock prices that came with a massive increase in trading volume. This kind of move, especially when it breaks a calm stretch in the market, usually means trouble is ahead.

That same day, ninety percent of the New York Stock Exchange trades were selling. That’s what’s known as a “90% down day.” And when that happens just after the market hits new highs, it’s rarely a good sign.

Here’s a closer look at what happened on that day.

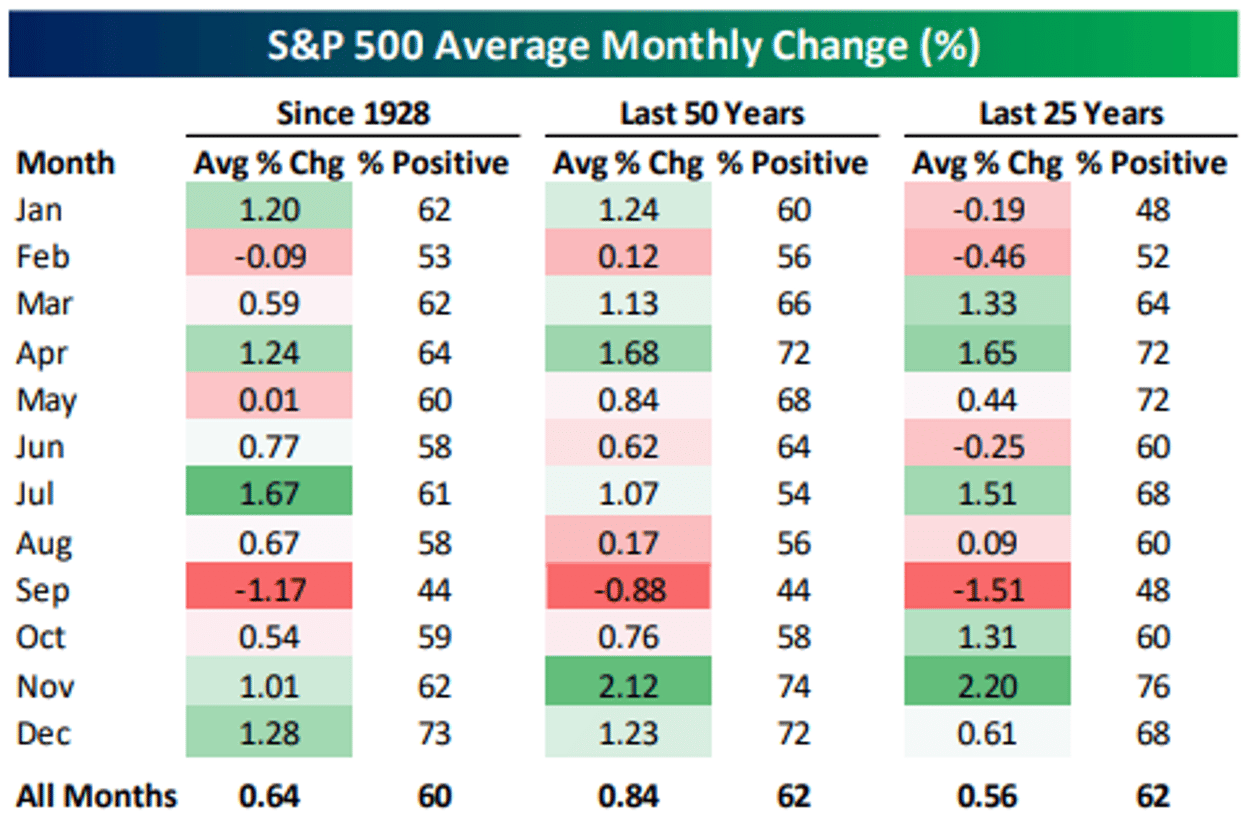

And now, let’s talk about the calendar.

September has always been one of the toughest months for the stock market.

We’re not just guessing here; this is backed by over a hundred years of data. On average, the market drops in September more than in any other month. And over the last twenty-five years, it's gotten even worse.

Check out this chart showing how September stacks up historically.

That alone would be enough to make us cautious, but two significant events are coming up that could really shake things up.

First, the monthly jobs report comes out this Friday.

Last month, the jobs numbers were a total surprise, not in a good way. The report showed that only 73,000 new jobs were added, far below expectations.

But even more shocking were the revisions. The numbers from May and June were changed and dropped by nearly ninety percent combined.

That hit the market hard! Investors might not take it so well if we see something like that again this week.

The second big thing comes next Tuesday, September 9.

That's when the Bureau of Labor Statistics releases its annual benchmark revisions. These updates go back and change the job numbers reported earlier in the year.

Last year, they took away over 800,000 jobs from the totals. That’s a massive adjustment!

If we get another big revision like that this time, it could make people question how strong the job market really is.

Here’s a look at how big that revision was last year.

With the market already stretched and with September being such a tough month historically, these two events could push stocks down quickly. And if stocks like Palantir, Robinhood, and NVIDIA are still trading well above their long-term averages, they might fall the hardest.

So, what can you do?

Now might be a good time to lock in some profits if you've made substantial gains on specific trades. It doesn't mean you have to sell everything, but taking some money off the table is okay, especially in stocks that are still running hot.

And if the market drops, don’t panic. Just be patient. Buying the dip has worked well over the last few years, but only when the dip is real.

Wait for a deeper pullback before jumping back in. A five percent drop in the S&P or a ten percent drop in the NASDAQ would be a better entry point.

If you think things might get bumpy, prepare now, not later, when emotions take over.

Write down what you want to do if the market drops, and follow that plan when the time comes. That’s how you stay calm when others are panicking.

Volatility is part of investing. But if you’re ready for it, you can turn a tough week into a win.

We’ll keep watching everything closely and send updates as things unfold.

Until next time,

The HX Research Team

HX Daily Redux

The DOJ Google Antitrust Suit

This week, a U.S. District Court ruled that Google will not be forced to divest key assets, namely, its Chrome browser or Android OS. This spared the company from the harshest remedies sought by the DOJ.

Instead, Judge Amit Mehta imposed a lighter punishment.

Essentially, Google must stop entering exclusive default search contracts and share specific search and user data with competitors.

The ruling thus preserves Google’s integrated ecosystem while promoting competition through more open access.

The market responded positively. Alphabet’s stock surged, reflecting investor relief and renewed confidence.

Now, at HX Research, we don't usually "toot our own horn," but in this case, we'd have to say… we totally called this outcome!

For this week’s “Daily Redux," we're revisiting a note we first published last August, when the DOJ case was announced, in which we predicted this week's outcome.

Enjoy!

Earlier this week, a federal judge ruled in favor of the US Department of Justice (DOJ)’s claim that Google had acted improperly and in a monopolistic fashion.

“After having carefully considered and weighed the witness testimony and evidence, the court reaches the following conclusion: Google is a monopolist, and it has acted as one to maintain its monopoly,” US District Judge Amit Mehta wrote in Monday’s opinion. “It has violated Section 2 of the Sherman Act.”

Almost a half dozen readers asked us what this means. This surprised us, and we don’t often answer questions about individual stocks. Given the interest, however, we decided it made sense to address this situation.

What does this really mean for Google? And Apple? And you?

First, let’s describe what exactly is going on here in an easy-to-understand fashion.

Google has negotiated contracts worth billions of dollars with key companies in the mobile telephone business. Mostly Apple and Samsung. These contracts position them as the “default” search provider on those phones.

This means that when you go use your phone to do an internet search – unless you actively go in and change the settings – you will automatically use Google for the search.

How many of you have ever gone in and changed the default search engine?

We are guessing that the answer is not many of you. We know that we haven’t.

Part of that is because we think Google is great. We are happy with the product.

The way to think about this deal is that the mobile handset companies own a piece of real estate. Think of it as a neighborhood with many houses (applications) and there is a street going into the neighborhood.

Google pays them a bunch of money so that their house will be at the front of the street, and everyone can see it.

Could another search engine (like Microsoft’s Bing) pay Apple and Samsung to have their house at the front of the street?

Absolutely. We are sure the handset companies will sell that spot to whoever is willing to pay the most money.

There are also no real arguments that Google is a bad search engine. In fact, the judge acknowledged that Google is recognized as the best search engine.

It is unclear how consumers are being harmed. We don’t pay for search engines.

So - what exactly is the problem?

Our view is that the “problem” is that politicians like to score points with the public by going against big technology. Whether there is harm to consumers or illegal activity is beside the point.

Why did the judge agree? At this point, much of our judiciary has become as politicized as the rest of our government.

Some argue that this judgment will be as monumental as past judgments that broke up monopolies like AT&T and Standard Oil.

We don’t think so.

What happens if Apple and Samsung make the default browser access non-exclusive? An open auction like sports rights.

It would be hard to argue then that other companies do not have access and are being disadvantaged.

We think that this will go into appeals for years, and eventually, sometime in two to five years, you will read about a settlement that is inconsequential to Google as a whole.

Remember that another administration may not pursue the same aggressive path as the current one.

Even if we are wrong about the eventual outcome, our legal process ensures that it will not happen quickly.

Do we think this judgment matters to Google?

In the next six to twelve months – we do not. We also do not think it will matter beyond that, but our view is that the focus with the stock should be on the earnings and that investors will forget about this quickly.

Market Wizard’s Wisdom

Howard Marks: Second-Level Thinking

For this week's "Market Wizard's Wisdom," we're revisiting a note we published last October about American investor and writer Howard Marks.

Over my three-decade career, I have been blessed to work with many smart people and benefit from the wisdom of some great investors.

Howard Marks, whom I have never met but whose insights have been a key part of my approach to my firms, is one of the great investment minds of our time. He is the co-founder of money-management firm Oaktree Capital Management.

Howard and I have never met, but his approach was deeply ingrained in the process of my last big hedge fund. In fact, Howard's son Andrew worked with us, and I am proud to say I helped him develop his analytical skills.

Howard is known for his comprehensive investment letters and memos, which he publishes for Oaktree.

He has a tremendous reputation. Read this quote from Warren Buffett, “When I see memos from Howard Marks in my mail, they're the first thing I open and read. I always learn something, and that goes double for his book."

The most powerful of Howard’s insights that we used was his concept of “Second-Level Thinking.”

Howard’s concept was that most investors operate with “First-Level Thinking.” This is where they buy a stock because the company is growing earnings or they are going to beat numbers.

The problem is that if THIS investor knows this information, then many other investors will likely KNOW it. The insight has no informational edge.

The challenge is that when the company reports the (expected) good news, the stock often does NOT perform as the investor hopes.

The key is to develop insights that are “Second-Level Thinking.”

Here is an excellent explanation of what he is talking about from a 2015 essay he published…

"Remember your goal in investing isn't to earn average returns; you want to do better than average. Thus, your thinking has to be better than others – both more powerful and at a higher level. Since others may be smart, well-informed, and highly computerized, you must find an edge they don't have. You must think of something they haven't thought of, see things they miss, or bring insight they don't possess. You have to react differently and behave differently. In short, being right may be a necessary condition for investment success, but it won't be sufficient. You must be more right than others…which by definition means your thinking has to be different…

For your performance to diverge from the norm, your expectations – and thus your portfolio – have to diverge from the norm, and you have to be more right than the consensus. Different and better: that’s a pretty good description of second-level thinking.”

We encourage you to read the entire essay here.

There is a LOT of wisdom packed in there!

We want to simplify it and tell you how we executed this insight in our firm.

The key was constantly challenging ourselves – are we simply thinking what everyone else is thinking?

This required a level of critical examination and reviewing as much of the data available as possible.

One of the great aspects of the modern investing world is we have access to an incredible amount of information. Every investor can access public sources like X/Twitter or StockTwits.

Spend a little money, and you can get access to other sources like Seeking Alpha. There is a ton of information to help you determine whether your thinking is consensus.

Our advice is that the more confident you are about a particular idea, the more you should challenge yourself about whether you are engaged in first-level thinking.

Our personal experience is that when we had the strongest conviction, it was often when the market also agreed with us the most. That is a dangerous place to be when investing.

Not only are you unlikely to produce better-than-average returns, but you are often setting yourself up for failure and volatility.

Again, we encourage you to read Howard's full essay above and familiarize yourself with his investment wisdom.

Are you familiar with Howard Marks' work? If so, share with us your favorite insight or quote from him in the comments section online or at [email protected]

We hope that you’ve enjoyed this week’s issue of HX Weekly…

What did you think of today's HX Weekly?Your feedback helps us create the best newsletter possible. |

Do you have any thoughts, questions, or feedback? Tell us more in the comment section or at [email protected].

Reply